4 Saving and Spending Solutions for the Opposites Who Attract

- Brian Page

- Jan 6, 2025

- 6 min read

You’re a saver, or at least your partner tells you so. You have a plan for most pennies that you’d stick to if it wasn’t for your spouse. At least, that’s what you tell yourself.

Your spouse is a spender. She doesn’t feel like it’s much of an issue because she enjoys living in the moment. She eats out when in a hurry or buys clothes that aren’t needed on a trip to Target to buy milk.

Money is often a source of conflict in relationships. It’s not uncommon for savers to become agitated when their partner continually impulsively spends. Nor is it unusual for savers to marry spenders.

Dr. Streib of Duke University says that these differences often arise in marriages between people who grew up in different social classes. According to Streib, "The person who grew up with little money wants to buy things they couldn’t as children, and isn’t as concerned with saving—they’ve gotten by their whole lives without a large savings account."

Streib continued, "The person who grew up with a safety net often wants to keep it, and so wants to save more.”

1. Talk to your spouse

Left unspoken, small transactions can feel like a series of micro stresses that eventually lead to an argument that seems strangely disproportionate to any single trip to the store.

Experts agree that working out your financial differences requires couples to communicate early and often. Yet, talking about money doesn't come easy for some.

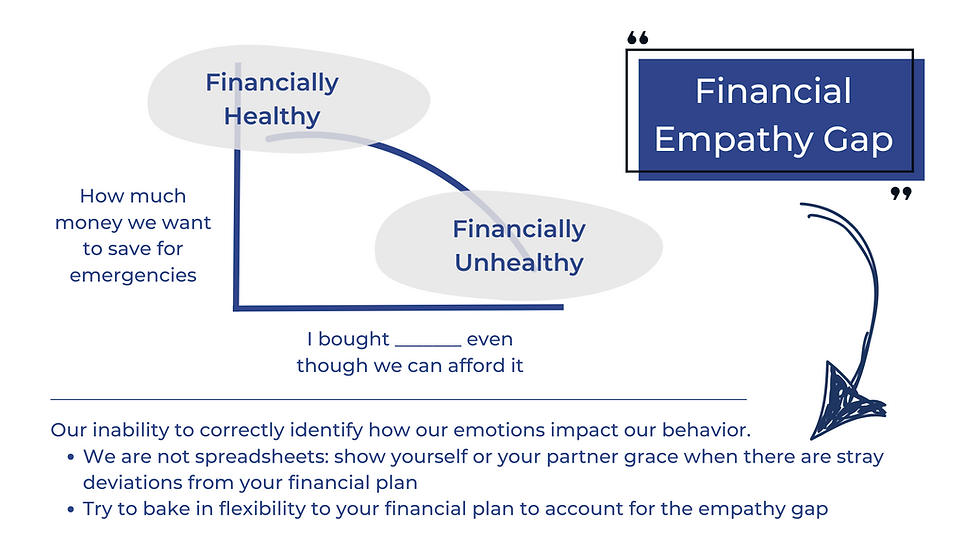

Our relationships with money often originate from our childhood and can be damaged by financial trauma. Talking with your spouse about money can be a skill requiring an empathetic approach to understanding your spouse's choices and responding to past mistakes free of blame and shame.

Experts agree that these conversations occur best in a scheduled and comfortable setting. Spending time regularly to discuss shared financial goals, values, and your relationship with money is often called money dates.

2. Use the Strategy: Yours, Mine, and Ours

Our relationships with money are deeply personal and originate from our upbringing.

“The use of money typically represents our strongest and most closely held values,”

says Dr. Sonya Lutter, director of financial health and wellness at Texas Tech University and owner of ENLITE.

“If we don’t want children to have the experiences we had as a child, we use our resources to provide experiences and stuff to avoid our unpleasant memories. Money brings the power and ability–to some extent–to modify our own emotions.”

According to Dr. Rick, author of Tightwads and Spendthrifts, “Complete financial transparency can lead to unnecessary fights over small purchases that don’t make much difference to your overall finances. It’s good to have a sense of what your partner is spending per week or per month, but there’s usually no need to get into the details.”

This is why Dr. Rick encourages Spendthrift and Tightwad couples to consider "Yours, Mine, and Ours."

Tightwads aren't just frugal. The highly frugal love to save, while the tightwads hate to spend. You can probably imagine how brutal honesty of full financial transparency can be agonizing for a tightwad reviewing line after line of spending by their spouse. It's not financial infidelity, just practicality.

The "Yours, Mine, and Ours" method uses separate and joint accounts, which means they have a common account for shared expenses and individual accounts for personal expenses.

It is important to know how income flows into expenses.

In this system, the joint account acts as a pass-through. Below is an example of how spouses and partners contribute to bills.

There are several advantages to splitting your finances in marriage using this approach, but it doesn't come without risks. For one, several studies, including recent research, have found an association between couples who pool their money together, higher marital satisfaction, and lower levels of divorce.

3. Find the Right Financial Tools

"To find the right tools for you and your partner, financial intimacy is essential. It involves communicating vulnerabilities and understanding each other's thoughts, attitudes, and emotions about money. Trust, consistency, and compromise form the foundation for a successful strategy as consistency is the only thing that compounds. ”

That is according to Dr. Thomas, who teaches at the University of Georgia and is passionate about advancing the behavioral, emotional, and psychological aspects of financial services.

Dr. Thomas continued, “Yield alone is insignificant without this deep understanding. Instead of focusing on yield, take the time to understand your partner's emotional response and barriers. This vulnerability will help you explore alternative options that both of you can confidently and sustainably act upon,”

Related: Dr. Thomas has been a past guest of the Modern Husbands Podcast.

Having a perspective that prioritizes the relationship is as important, if not more, than chasing the high-saving yield environment we are experiencing today.

The Federal Reserve rate hikes over the past year have made chasing higher returns worth our time. As a matter of fact, 6% APY savings accounts arrived in July of 2023! These returns compound over long periods and can certainly add up over the next year if the amount deposited is substantial.

High-Yield Savings Accounts

These accounts are offered by online banks and credit unions, and they often provide higher interest rates compared to traditional brick-and-mortar banks. You can check various online banks and compare their rates to find the best option for you.

Money Market Accounts

Money market accounts are similar to savings accounts but typically offer slightly higher interest rates. They often come with limited check-writing abilities and may require a higher minimum balance.

Certificates of Deposit (CDs)

CDs are time deposit accounts where you deposit a fixed amount of money for a specific period, ranging from a few months to several years. In return, you receive a fixed interest rate that is generally higher than that of regular savings accounts. The longer the CD term, the higher the interest rate tends to be.

CD Laddering

A CD ladder typically involves splitting equal amounts of cash among multiple CDs with different maturity dates. There are various approaches to CD Laddering, explained best in this recent episode of the WSJ podcast Your Money Briefing.

4. Cool Off

Dr. Stephen Shu is a behavioral economist who teaches at the Cornell University Charles H. Dyson School of Applied Economics and Management.

According to Dr. Shu, "Impulsive spending largely involves fast, automatic thinking associated with emotions and feelings in the moment. People are often in a hot state when impulsive purchases happen. For example, think of grocery shopping when hungry."

Dr. Shu went on to explain that couples benefit when systems, habits, or agreements are implemented to slow thinking into a more reflective, colder state.

Delay shopping for a couple weeks after a monthly paycheck has been received, as opposed to just when the monthly paycheck hits and people feel richer and good. The delay could be just long enough for the couple to do things together, even just a few days. Providing each other's perspectives is beneficial when making spending and savings choices.

"What works for some couples might not work for others. However, the key is to consider slowing down thinking, thinking about goals versus alternatives, and having some discipline to test different methods and see which ones work for you," Dr. Shu added.

If systems that bake in simple restraints are ineffective, consider systems that also include short-term spending goals on things the couple agrees to do together, such as a weekly date, or weekend getaways every few months.

Follow Modern Husbands

Start, Strengthen, or Rebuild Your Marriage. Our Marriage Toolkit empowers couples with evidence based ideas from 40+ of the nation’s leading experts in managing money and the home as a team.

Winning ideas from experts to manage money and the home as a team. 2023 Plutus Award Finalist: Best Couples or Family Content

🔔 Click here to listen and subscribe to the Modern Husbands Podcast on Apple.

🔔 Click here to listen and subscribe to the Modern Husbands Podcast on Spotify.

Winning ideas to manage money and the home as a team delivered to your inbox every two weeks. You'll even receive a few free gifts!