The Credit Score Playbook: 10 FAQs to Build, Boost, and Protect Yours

- Brian Page

- Dec 1, 2025

- 3 min read

In a dual-career household, financial teamwork is everything. But one number can make or break your ability to rent a home, buy a car, or qualify for a mortgage: your credit score. Understanding what impacts it, and how to improve it, can help you and your partner make smarter financial decisions together.

10 Credit Score FAQs

Below are real-world answers to the most common questions couples ask about credit scores, explained in plain English.

What Is a Credit Score, Really?

A credit score is a number that tells lenders how trustworthy you are with borrowed money. The most widely used version (FICO score) is based on five main factors:

35% – Payment History

30% – Amounts Owed (a.k.a. Credit Utilization)

15% – Length of Credit History

10% – Credit Mix (different types of credit accounts)

10% – New Credit Inquiries

Bottom line: Pay your bills on time and keep your credit card balances low to protect your score.

Why Do Lenders Use FICO and VantageScore?

Lenders use FICO and VantageScore because they’re both trusted, data-driven tools that help predict risk. FICO has been around longer and is more commonly used for mortgage lending. VantageScore is newer and often emphasizes your recent credit behavior.

Both use similar 300–850 scoring ranges, but calculate your score slightly differently.

How Can a Low Score Hurt You?

A low credit score can make everyday things harder:

Renting a home: Landlords may require a higher deposit—or reject your application.

Getting a loan: You’ll likely face higher interest rates or be denied altogether.

Landing a job: For roles involving finances or security clearance, a bad credit report can be a dealbreaker.

Most Common Mistakes That Lower Scores

Let’s bust two big myths:

Carrying a balance helps your score.False. It can actually cost you in interest and raise your utilization.

Closing old credit cards is harmless.Wrong. It shortens your credit history and can raise your utilization ratio.

How Bad Is One Late Payment?

Pretty bad. Payment history is 35% of your FICO score. A single late payment (30+ days past due) can drop your score by 60 to 110 points, especially if you normally have a good track record.

Pro tip: Try the FICO Score Simulator to see how it could impact your score.

What’s the Ideal Credit Utilization Rate?

Many people think staying under 30% is enough—but the real goal is under 10%, and closer to 0% is best.

One tip? Pay your credit card balances frequently—even daily. That’s how I broke the ceiling and earned a perfect FICO 8 score.

When Should You Close a Credit Card?

Close a credit card only when:

The annual fee outweighs any benefits

The card tempts you to overspend

But beware: it may hurt your score by shrinking your available credit and shortening your credit history—especially if it’s an older account.

Fastest Ways to Boost Your Score

Need a quick bump before applying for a mortgage? Try this:

Pay down credit card balances early and often

Dispute any credit report errors—these can sometimes lead to instant gains

Avoid new hard inquiries unless absolutely necessary

Is Experian Boost Worth It?

If your credit history is thin, yes. Experian Boost pulls in your utility and phone bill payment history, which normally doesn’t count toward your score. It won’t solve everything, but it’s a helpful nudge in the right direction.

Rebuilding After a Setback (Like Bankruptcy)

The first step is regaining lender trust:

Open a secured credit card

Use it for small, regular purchases

Pay it off in full every month

It takes time, but these habits will rebuild your credit and your confidence.

Final Thoughts: Credit Scores Aren’t Everything—But They Matter

Managing credit as a team is part of building a strong financial foundation in your marriage. Whether you’re recovering from a setback or just aiming for the best rate on your next loan, knowing how credit scores work can help you make smarter, more confident decisions—together.

Professional Guidance

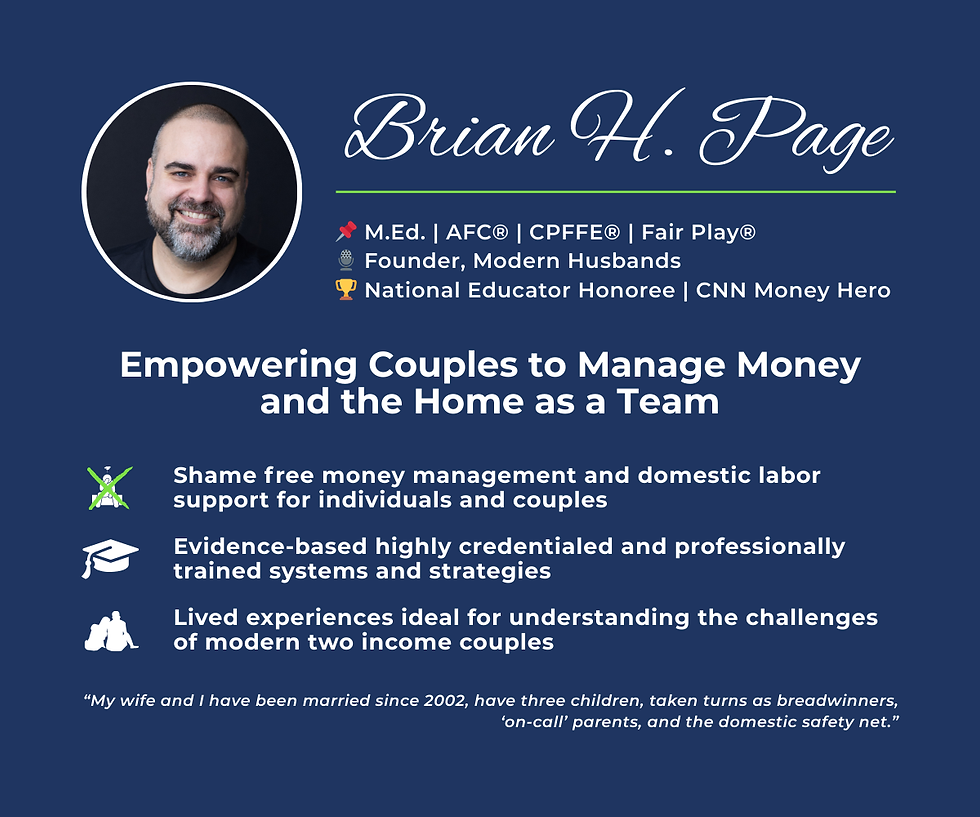

I support couples who want to better manage money or the home as a team in their relationship.

I'm the only Accredited Financial Counselor® and Fair Play Facilitator®, empowering high-achieving couples with systems to manage money and the home as a team — drawn from decades of national leadership and lived experience.

Contact me to set up a free 15 minute exploratory call.