Five Smart Considerations for Couples Choosing Health Insurance

- Brian Page

- Nov 18, 2025

- 3 min read

Health insurance premiums are skyrocketing across the country, and couples everywhere are feeling the pinch. Choosing a plan is no longer as simple as picking the lowest monthly premium or sticking with whatever you had last year.

The stakes are higher now.

Nearly everyone’s premiums are skyrocketing in 2026. Hope and I just selected our employer sponsored plan. The premiums increased by 19%.

For those who purchase insurance on the marketplace (ACA / ObamaCare), your premiums could more than double.

A plan that looks affordable on paper can lead to painful surprises throughout the year, while a more expensive option could actually save you money in the long run.

If you and your partner are weighing your options this open enrollment season, here are five smart considerations that prioritize both affordability and meaningful coverage.

1. Compare the Total Annual Cost, Not Just Monthly Premiums

It is easy to focus on how much comes out of your paycheck each month, but premiums are only one piece of the puzzle. Deductibles, co-pays, co-insurance, and out-of-pocket maximums work together to determine what you will really spend over the course of a year.

A plan with a low premium can end up costing far more if it comes with a high deductible or a steep out-of-pocket maximum. Run the numbers for the full year, including the worst-case scenario. For many dual-career couples and families, the out-of-pocket maximum is one of the most important numbers to review. It represents the ceiling of your annual financial risk.

2. Review Your Current and Anticipated Health Needs

Every couple has different health care needs, so the right plan depends on what you use most. Make a simple list of your expected health expenses. Include prescriptions, regular therapy appointments, prenatal or fertility planning, chronic conditions, specialist care, or anything you anticipate needing in the coming year.

This quick inventory helps you determine whether a High Deductible Health Plan paired with an HSA makes sense or whether a PPO or HMO provides better protection. Sometimes a plan with a higher premium is more affordable overall because it covers the services you use most.

3. Compare Employer Plans Side by Side

If both partners have access to employer-sponsored medical plans, take the time to compare them carefully. Look at how much each employer contributes, review the quality of each network, and check for spousal surcharges that may make joint enrollment more expensive.

Some couples save money by joining one family plan. Others reduce costs by each partner enrolling in their own employer plan. There is no one-size-fits-all answer. What matters is examining the options instead of defaulting to the familiar.

4. Prioritize Network Quality and In-Network Providers

Affordability does not matter if you cannot see the providers you trust. Before selecting a plan, check that your preferred doctors, specialists, mental health providers, and nearby hospitals are in network.

Out-of-network visits often come with significant costs, and couples are increasingly finding that plans with low premiums also come with sparse provider networks. A plan that looks affordable can quickly become one of the most expensive options when you factor in unexpected out-of-network bills.

5. Consider the Tax Advantages of HSAs and FSAs

Health accounts can make a meaningful difference in your budget. HSA-compatible plans allow you to contribute pre-tax dollars that roll over every year and grow tax free. FSAs can also reduce your taxable income, though they require careful planning because unused funds do not roll over in the same way.

For some couples, choosing a plan that aligns with a long-term tax strategy ends up saving hundreds or even thousands each year. HSAs in particular can act like investment accounts that support both health expenses and future retirement planning.

Professional Support

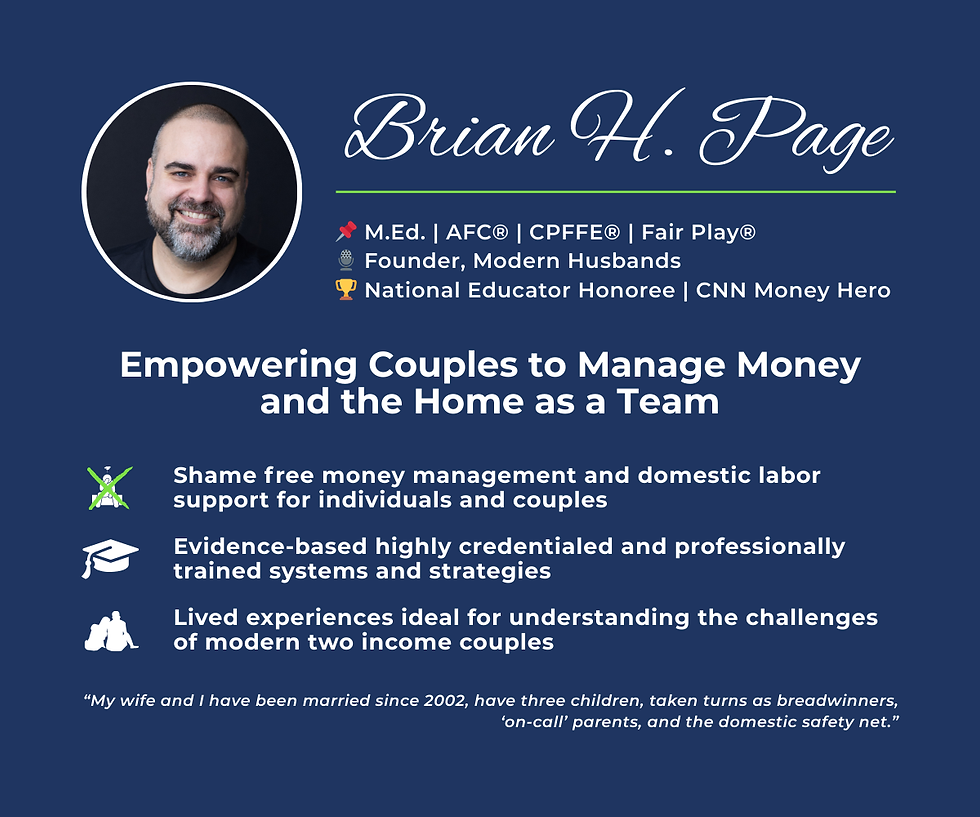

I support couples who want to better manage money or the home as a team in their relationship. I am also available for group coaching events.

I'm the only Accredited Financial Counselor® and Fair Play Facilitator®, empowering high-achieving couples with systems to manage money and the home as a team — drawn from decades of national leadership and lived experience.

Click here to schedule a free 15 minute exploratory call.

For more ideas to manage money and the home as a team in your marriage, click here to take advantage of our free preview of our Marriage Toolkit.