3 Ways to Overcome the Financial Empathy Gap in Your Marriage

- Brian Page

- Jul 28, 2025

- 4 min read

Updated: Jul 28, 2025

Forget the money. Focus on feelings.

Money matters are one of the top causes of disagreements among couples. And that, in itself, makes it necessary to mind our money in our marriage.

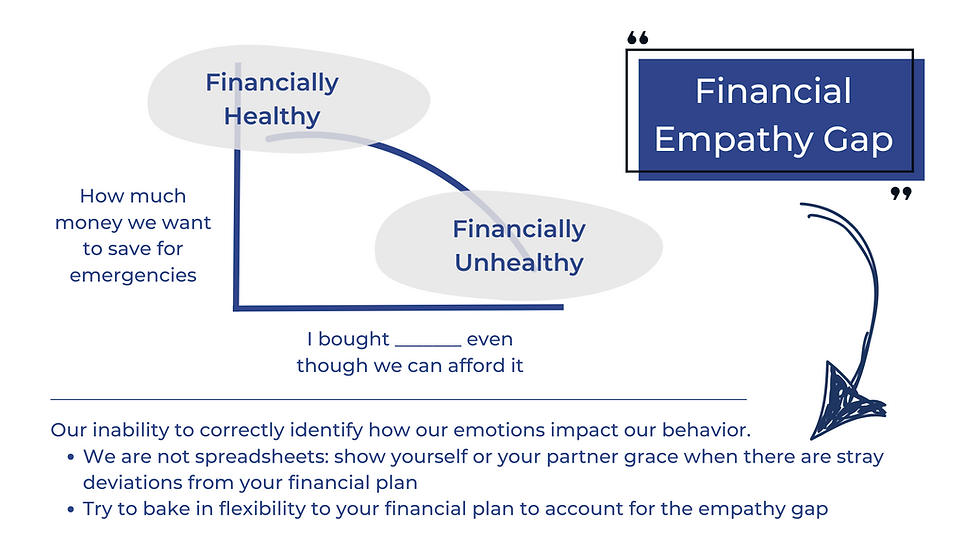

The Financial Empathy Gap

Our emotions play a significant role in our financial decision-making. Many argue that much more so than our financial knowledge. The gap in our inability to correctly identify how our emotions impact our behavior is the financial empathy gap.

And it is THIS issue that can be the root of marital disputes about money.

When we underestimate the impact of emotions on our financial choices, we fail to factor in emotions when making predictions. We often falsely believe that the feelings we experience when setting financial goals are no different from the feelings we have when facing the temptations of straying from our goals.

The financial empathy gap also makes us less likely to understand the behavior of spouses in different emotional states.

Let me explain.

How the financial empathy gap works

Imagine setting a budget together with your partner. Three weeks later, you're reviewing your credit card statement and notice quite a few significant transactions made by your spouse on a night out with her friends. She intended to follow the budget but failed to adhere to the spending plan you had built together.

When you agreed on a spending plan, you were thinking rationally, free of emotion. When your partner overspent, she was overwhelmed with emotion. She was with her best friends from college, a few of whom she hadn't seen in years. Why? One of them had just lost her husband. The furthest thing from her mind was a spreadsheet.

We're human beings, not Excel spreadsheets. So keep that in mind when approaching your spouse about her spending decisions.

She didn't fail to budget. Y'all failed to put systems in place to make it harder to deviate from the budget you built together.

She didn't fail to budget. Y'all failed to put systems in place to make it harder to deviate from the budget you built together.

It is almost impossible for us to avoid the influence of emotions on our behavior; therefore, we must acknowledge their impact. The empathy gap is primarily an issue that causes us to wrongly predict our future behavior. By understanding that our emotions, not just rational logic, impact how we act, we can take emotions into account in our predictions.

Solutions: Overcoming the Financial Empathy Gap

1. Open Communication

Communication is the cornerstone of any relationship, and this holds especially true when it comes to finances. Often, financial problems arise not from the issue itself but from a need for more open discussion about it.

Couples should regularly discuss their financial status, goals, and concerns. Such conversations can involve discussing income, debt, savings, and spending habits. Transparency and honesty are crucial, as they can help avoid miscommunication and misunderstandings.

We have two go-to articles for folks hesitant about having an open conversation with their spouse about money:

What to talk about matters much more than simply talking. Making it easier to make good decisions and harder to make bad ones is far more important.

2. Devise Systems for Success

As mentioned in our previous post, "Why Budgets Do NOT Work," people who are good at self-control structure their lives to avoid making self-control decisions.

More specifically, make good decisions easier to make and bad decisions harder to make.

3. Agree on Major Financial Decisions

Couples should always consult each other before making significant financial decisions. Decisions can range from making large purchases to investment choices. Agreeing on a spending limit for individual purchases can help prevent disagreements and disputes.

Spending limits can also promote a sense of fairness. Both partners have the same spending cap, so no one feels like they're shouldering more financial responsibility.

Professional Support

As the only Accredited Financial Counselor® and Fair Play Facilitator® in the country, I work with couples to help them manage money and the home as a team. That means looking at more than just the numbers. It means digging into the roles, expectations, and habits that shape your financial life and creating a plan that works for both of you.

Let's stop letting money pull you apart. Let's start using it to bring you closer together.

➡️ Book a free 15-minute consultation to see how I can support your relationship and financial goals.

Follow Modern Husbands

Winning ideas from experts to manage money and the home as a team. 2023 Plutus Award Finalist: Best Couples or Family Content

🔔 Click here to listen and subscribe to the Modern Husbands Podcast on Apple.

🔔 Click here to listen and subscribe to the Modern Husbands Podcast on Spotify.

Winning ideas to manage money and the home as a team delivered to your inbox every two weeks. You'll even receive a few free gifts!

Citations

Leger, Patrick. “The Best Ways for Couples to Manage Finances.” The Wall Street Journal, 14 Feb. 2022, www.wsj.com/articles/best-ways-for-couples-to-manage-finances-11644264301.

Mischel W, Ebbesen EB, Zeiss AR. Cognitive and attentional mechanisms in delay of gratification. J Pers Soc Psychol. 1972 Feb;21(2):204-18. doi: 10.1037/h0032198. PMID: 5010404. https://pubmed.ncbi.nlm.nih.gov/5010404/

Saxler, Patricia Kasak. 2016. The Marshmallow Test: Delay of Gratification and Independent Rule Compliance. Doctoral dissertation, Harvard Graduate School of Education. https://dash.harvard.edu/handle/1/27112705

Galla BM, Duckworth AL. More than resisting temptation: Beneficial habits mediate the relationship between self-control and positive life outcomes. J Pers Soc Psychol. 2015 Sep;109(3):508-25. doi: 10.1037/pspp0000026. Epub 2015 Feb 2. PMID: 25643222; PMCID: PMC4731333. https://pubmed.ncbi.nlm.nih.gov/25643222/

“Empathy Gap.” The Decision Lab, thedecisionlab.com/biases/empathy-gap. Accessed 3 Aug. 2023. https://thedecisionlab.com/biases/empathy-gap