Her Income, His Income, Our Income: Three Charts Defying Common Sense

- Brian Page

- Nov 13, 2025

- 3 min read

40 years ago, there were nearly twice as many households with an employed husband and a non-working wife as there were dual-income households.

And, of course, women contributed much more time to managing the home and caregiving than men did. Right or wrong, that was at least rational.

Now there are more than twice as many dual-income households as households consisting of an employed husband and a non-working wife.

Yet, on average, women continue to spend significantly more time working in the home than men do. My goodness, look at the difference in time spent managing a home before and after divorce.

That's irrational. That's unfair. That's a broken system breaking marriages.

Leaning on "traditional values" to justify an irrational and unfair system is not okay.

It's fine if one partner manages most of the home and the other focuses on generating most of the household income, as long as it leads to equal leisure time and makes for a happy marriage. Hell, if that's what makes y'all happy, then that's great!

I'm not anti-trad wife, I'm anti-unfair.

Asking your wife to work full-time and come home and do what women did forty years ago is flat out wrong.

I taught AP macroeconomics and microeconomics for 15 years. And from an economic perspective, it's also asinine. Let's talk about comparative advantage for a moment.

Comparative advantage is the ability of an individual or group to carry out a particular economic activity more efficiently than another activity.

Nearly half of women earn as much or more than their husbands. If your wife has a higher income ceiling now or in the future, basic economics, that is, comparative advantage, would tell you to structure your home system for her to continue to focus on her career, and perhaps it is men who continue to work but take on a bigger role at home or as caregivers.

Consider that after a child is born, most marriages default to a broken system that plummets her earnings, which are also the household earnings.

Economist Dr. Claudia Goldin highlighted this issue in her Nobel Prize-winning research on the gender pay gap. What she found was that all things equal, the gender pay gap has been nearly eliminated until a child enters the home. After which, it explodes.

For every year a woman leaves the workforce to be a caregiver, she loses $295,000 in lifetime compensation. Yet that remains the default.

Again, if that's by choice because that's what makes for a happier marriage – great! I'm here to celebrate happiness!

But that's not always the case. All too often, couples slip into this arrangement, leaving hundreds of thousands of dollars in lost income on the table while creating resentment.

For folks who refuse to allow gender to define happiness, I want to recommend three resources.

First, check out my free family financial planning calculator. By inputting your circumstances, such as income levels now and in the future, and the cost of childcare, you can see what the financial implications of each choice would be after 15 years.

Second, read Having It All: What Data Tells Us About Women's Lives and Getting the Most Out of Yours. The author is Dr. Corinne Low, an economist who teaches at Penn's Wharton School. She uses economic concepts and data to help couples make informed decisions about home management and caregiving.

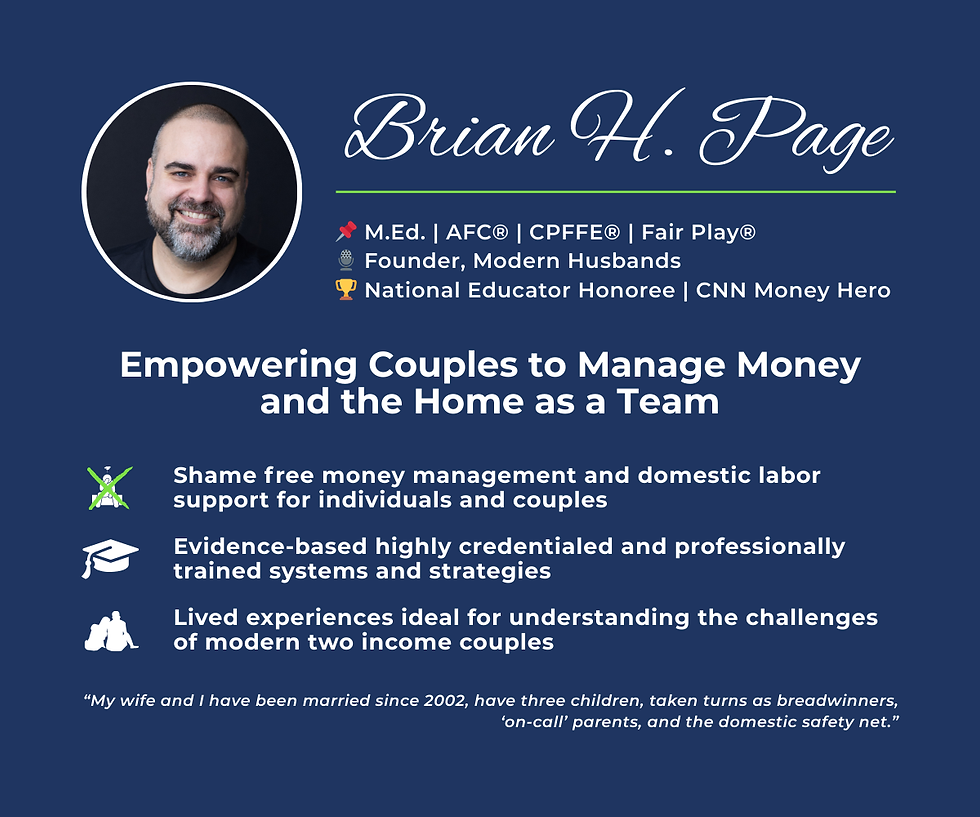

Third, reach out if you need professional 1:1 or couples support. I am the only Accredited Financial Counselor who is also a Fair Play home labor specialist. I empower couples with systems to manage their daily finances and homes with fairness and efficiency.