How Couples Can Strengthen Their Credit Together in a Shifting Economy

- Brian Page

- Sep 17, 2025

- 4 min read

Credit scores quietly shape major decisions in our lives—buying a home, getting a car, renting an apartment, even landing a job. And in a financial climate where inflation, rising interest rates, and student loan repayments collide, couples can no longer afford to ignore their credit health.

The latest FICO® Score Credit Insights report shows the national average credit score has dipped to 715—the first significant decline in years.

For dual-career couples juggling bills, debt, and dreams, your credit score isn’t just a number. It’s a shared asset that deserves joint attention.

Let’s unpack what’s happening, what it means for your household, and how to manage your credit like a team.

A Shifting Credit Landscape

FICO’s report paints a sobering picture. For the first time in years, fewer Americans fall in the middle score ranges. Instead, more people are landing in either the very high or very low brackets. In 2021, 38.1% of people had scores between 600–749. By 2025, that number dropped to 33.8%.

The economy’s “K-shaped” recovery is likely to blame. While some households benefit from home equity and strong stock portfolios, others are struggling with affordability challenges and rising debt loads.

Gen Z has been hit especially hard. The average score for 18–29 year-olds is just 676—39 points below the national average. Worse, 14.1% of Gen Z saw a 50+ point score decrease in the past year alone. The reasons? Inflation, inexperience with credit, and a heavy burden of student loans.

And it’s not just Gen Z. Credit card balances have risen 34% since 2021, with utilization rates now at 35.5%—well above the ideal target of under 10%

Why Student Loan Delinquencies Are Spiking

Millions of borrowers are now feeling the sting of a delayed but powerful credit punch. When the pandemic began in 2020, the CARES Act paused federal student loan payments. While payments resumed in October 2023, credit reporting for delinquencies was delayed until February 2025.

That “on-ramp” is over, and the impact is massive. From February to April 2025, 6.1 million Americans had a student loan delinquency added to their credit report. Those borrowers saw their FICO scores drop by an average of 69 points. About 25% experienced score drops of over 100 points.

Why such a steep penalty? Delinquencies fall under the “Payment History” category of your FICO score, which accounts for about 35% of the score’s weight. And when a loan goes 90+ days past due, it signals serious risk to lenders.

Many borrowers simply weren’t ready. Some hadn’t made a payment in three years—or ever. Some didn’t know who their servicer was after multiple account transfers. Others assumed there were no consequences yet.

What Couples Should Do About Student Loans

This is the time for teamwork, not finger-pointing. If one or both of you has student debt, take the following steps together:

Get organized: Know who services your loan, how much you owe, and when payments are due.

Set up autopay: Even minimum payments can protect your score.

Catch up if behind: Contact your servicer to explore Fresh Start programs or consolidation to exit default.

Communicate openly: Hiding student loan struggles from your spouse can strain both your relationship and your finances.

The Power of Paying Down Credit Cards—Often

While student loans are causing credit score drops, there’s another sneaky culprit lurking: credit card utilization.

Utilization is the amount of credit you’re using divided by your total credit limit. It’s the second most important factor in your FICO score—about 30% of your score calculation.

Most people assume paying off the full balance each month is enough. But credit card companies usually report your balance to the credit bureaus before your payment clears. That means your score could reflect a high balance, even if you pay it off days later.

Pro Tip:

Pay your credit card balances weekly—or even daily—to keep your utilization below 10%, ideally close to 0%.

Example: Let’s say you spend $2,000 on a card with a $5,000 limit. Your utilization is 40%. But if you make multiple $500 payments throughout the month, your balance stays low and your utilization looks much healthier—boosting your score.

This is especially important for couples with joint accounts or shared authorized user cards, where one partner’s spending could affect both credit profiles.

Strengthening Credit as a Team

Improving your credit score doesn’t require perfection. It requires consistency, communication, and collaboration. Here’s how to approach it together:

Review your reports: Use AnnualCreditReport.com to download all three reports—Equifax, TransUnion, and Experian—once a year.

Check your scores monthly: Especially helpful for younger couples. Just don’t obsess over daily fluctuations.

Share the mental load: If one person is tracking the mortgage and the other is managing student loans, be transparent about due dates and balances.

Use reminders and automation: Protect your credit by minimizing the risk of forgotten bills.

Lead with empathy: Credit mistakes are common. Use them as teachable moments, not triggers for blame.

Final Thoughts: Small Habits, Big Impact

Despite a dip in the national average, credit scores across the U.S. are still strong by historical standards. But cracks are forming, especially among younger borrowers and households juggling multiple types of debt.

For dual-income couples, managing credit is a shared responsibility—and a shared opportunity. Together, you can take simple steps to protect your score:

Make frequent credit card payments to lower utilization.

Stay on top of student loans and avoid falling into default.

Review your reports, set up autopay, and talk often about your financial priorities.

Because your credit health isn’t just about interest rates—it’s about the kind of life you’re building together.

Professional Support

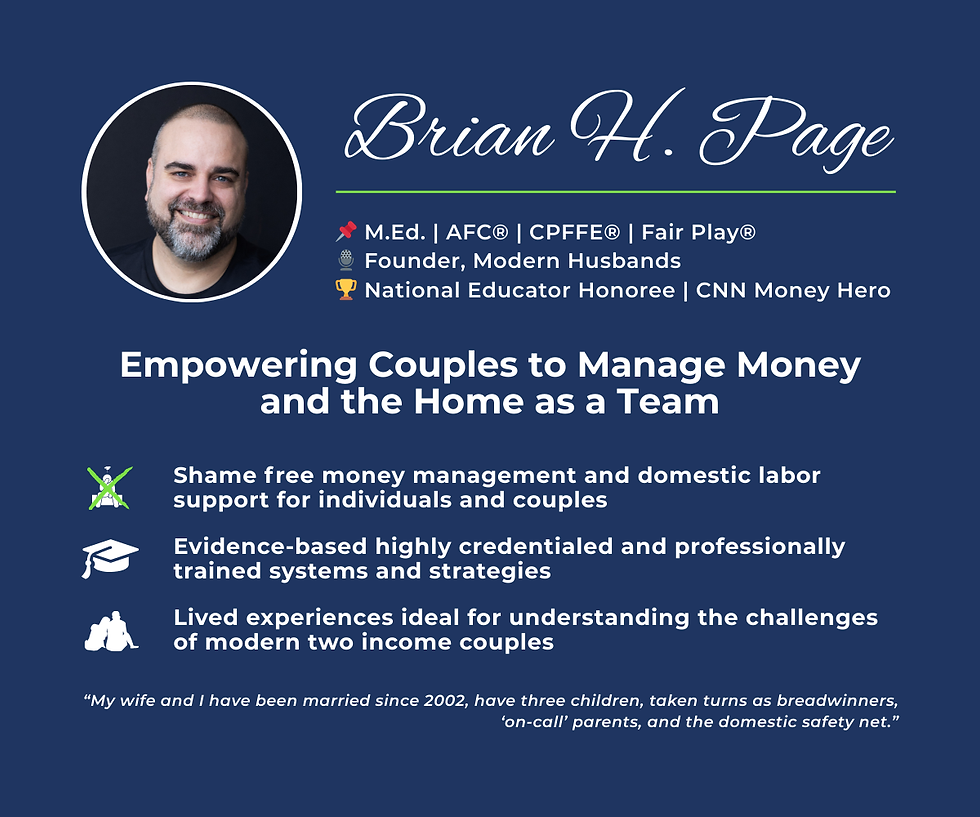

I support couples who want to better manage money or the home as a team in their relationship.

I'm the only Accredited Financial Counselor® and Fair Play Facilitator®, empowering high-achieving couples with systems to manage money and the home as a team — drawn from decades of national leadership and lived experience.

Click here to schedule a free 15 minute exploratory call.

For more ideas to manage money and the home as a team in your marriage, click here to take advantage of our free preview of our Marriage Toolkit.