Should You Buy or Lease an Electric Car Before the EV Tax Credit Disappears?

- Brian Page

- Sep 11, 2025

- 4 min read

As the year winds down, many families start weighing big-ticket financial decisions. For some, that includes whether to buy or lease a new vehicle. But if you’ve been eyeing an electric car, there’s more urgency than usual.

No, I’m not here to sell you on a specific make or model. And no, I don’t have affiliate links. But I did warn about this back in November 2024, right after the election, when it became clear that a shift in leadership would likely impact electric vehicle (EV) incentives. That time has come.

The Big Policy Change: EV Credits Are Expiring Sooner Than Expected

Thanks to a new budget reconciliation bill, officially known as the One Big Beautiful Bill Act, the federal tax credits that once made EVs significantly more affordable are set to expire much sooner than planned.

Originally, the Inflation Reduction Act (IRA) extended new and used EV tax credits through 2032. The new legislation shortens that timeline by a full seven years. Now, the $7,500 federal tax credit for new electric and plug-in hybrid vehicles, and the $4,000 credit for eligible used EVs, will expire on September 30, 2025.

Here’s the good news: if you sign a binding contract and make a payment before that date, even if the car is delivered later, you can still claim the credit. This includes down payments or vehicle trade-ins. But once the window closes, so do the savings.

For more details on the rules, eligible vehicle models, income thresholds, and final assembly requirements, Consumer Reports has an excellent breakdown. It’s worth checking out before making a decision.

This Was Predictable

Back in late 2024, I cautioned Modern Husbands readers that changes like this were coming. With the GOP controlling Congress and President Trump taking office, the Inflation Reduction Act was never going to stand unchallenged.

In fact, Trump posted on his Truth Social account threatening broad tariffs on imported auto parts from Mexico and Canada. That’s a serious concern when you consider that roughly half of U.S. auto parts come from those two countries.

Fortune reported that a 25% tariff on auto parts could increase the price of a U.S.-assembled vehicle by $2,100. If you’re planning to buy or lease a car in the next year or two, those added costs could hit your household budget hard.

Combine those looming tariffs with the expiration of EV tax credits, and the smart move for many families might be to act sooner rather than later.

Should You Buy or Lease? Gas or Electric?

Let’s break down the pros and cons of each option so you can make the best decision for your family.

Buying an Electric Vehicle

Pros:

Full ownership with no mileage restrictions

Up to $7,500 in tax credits (if you act before the deadline)

Long-term savings on fuel and maintenance

Cons:

Higher upfront cost

Depreciation risk, especially as EV tech evolves rapidly

Leasing an Electric Vehicle

Pros:

Lower monthly payments

Flexibility to upgrade every few years

Most leases cover maintenance during peak performance years

Cons:

You don’t own the car

Mileage caps and dealer markups may apply

The commercial lease loophole that allows leasing companies to claim the tax credit ends in 2025

Buying a Gas-Powered Vehicle

Pros:

Lower sticker prices and more dealer incentives

Easy servicing infrastructure

Cons:

Higher long-term costs for fuel and upkeep

No federal tax incentives

May be phased out by manufacturers over time

Leasing a Gas-Powered Vehicle

Pros:

Low upfront cost

Useful if you’re unsure about long-term vehicle needs

Cons:

You’re stuck with rising gas prices

Zero climate or tax benefits

Run the Numbers

Not sure which option actually saves you the most money? Fortunately, The New York Times created this calculator that compares the cost of owning an EV versus a gas-powered car.vUse the calculator to model:

Daily driving distance

Local energy and fuel prices

Charging habits

Tax credit eligibility

You can find the tool by clicking here. It’s a great way to take emotion and guesswork out of the equation.

Make It a Team Decision

If you’re in a dual-career household, you already know that the best financial decisions are made together. Whether you’re looking for a daily commuter, a family hauler, or something that aligns with your values on sustainability, this decision deserves a thoughtful conversation.

I recommend sitting down with your partner for a “car money date.” Discuss:

Who drives more and for what purposes (commute, kids, errands)

Monthly budget for car payments, insurance, and fuel or charging

Desire for flexibility versus ownership

Shared environmental goals

For more help, refer to the Modern Husbands Car Buying Guide, which outlines how to approach big financial decisions as a team.

Final Thoughts: Don’t Panic, But Don’t Wait Too Long

According to Consumer Reports, you shouldn’t rush out and buy an EV just to get a tax credit. That’s smart advice. But if you’ve already done your research and you know what you want, acting before the September 30, 2025 deadline could save you thousands.

If you’re not ready to complete a purchase now, consider placing a refundable deposit and locking in a binding contract. This preserves your eligibility while giving you more time to plan.

The EV market is still evolving, but one thing is certain: the incentives that have made these cars more accessible are disappearing. Add the risk of rising tariffs, and it’s clear that waiting too long could hit your family in the wallet.

Make your decision deliberately, with the right data, and with your partner by your side.

Professional Support

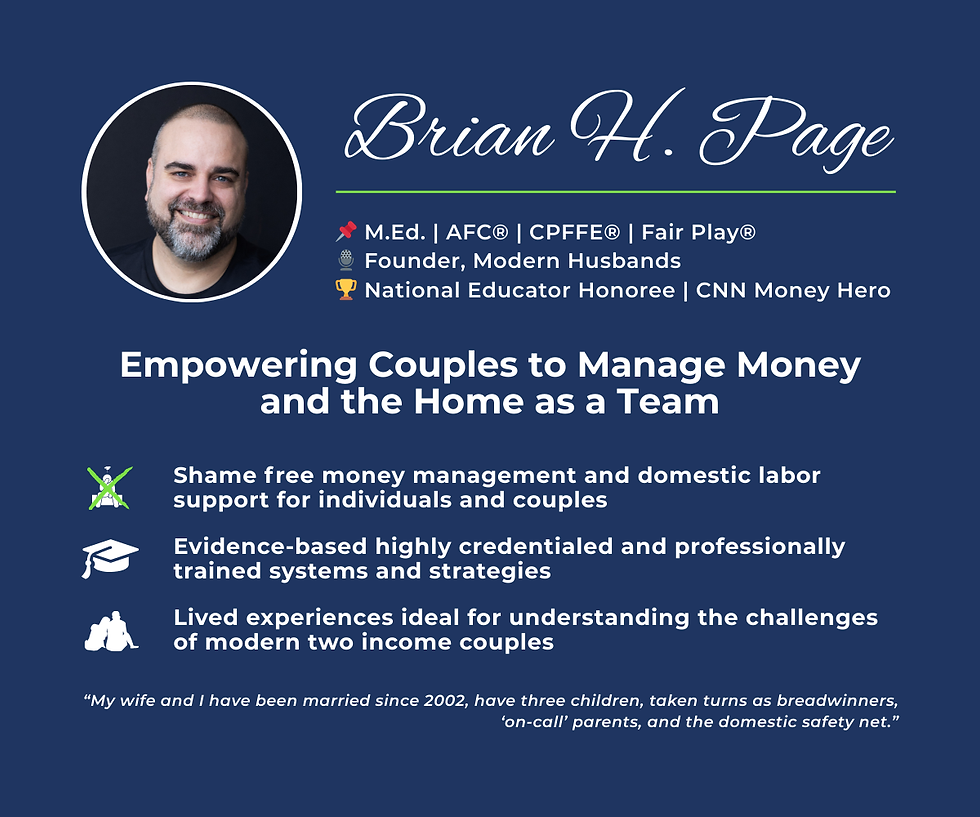

I support couples who want to better manage money or the home as a team in their relationship.

I'm the only Accredited Financial Counselor® and Fair Play Facilitator®, empowering high-achieving couples with systems to manage money and the home as a team — drawn from decades of national leadership and lived experience.

Click here to schedule a free 15 minute exploratory call.