Why More Couples Are Rethinking Joint Bank Accounts and What It Means for Trust and Happiness

- Brian Page

- 10 hours ago

- 4 min read

For decades, the default advice for couples was simple: open a joint bank account and combine everything: one household, one pot of money. But a growing number of couples are moving away from that model, and it is not because they are less committed.

According to 2023 data from the U.S. Census Bureau’s Survey of Income and Program Participation, the share of couples without any joint bank accounts rose by more than half, from 15% in 1996 to 23% in 2023.

The shift is especially noticeable among younger and dual-career couples. At first glance, separate accounts can look like a warning sign. In reality, they often reflect changing life circumstances, financial complexity, and a desire to reduce friction rather than create it.

Why Couples Keep Some Money Separate

It’s not uncommon for couples to include a partner who has experienced Financial Trauma in childhood or a past marriage that has created such strong financial distrust that they are unwilling to share accounts.

Blended families introduce another layer of complexity. Couples with children from prior relationships often have ongoing financial commitments that predate their current partnership.

Some couples keep some money separate to reduce daily conflict that can typically be solved with a hybrid system such as Ours, Yours, and Mine.

Professional Support

As the only Accredited Financial Counselor®, Certified Financial Therapist™, and Fair Play Facilitator® in the country, I work with couples to help them manage money and the home as a team.

➡️ Book a free 15-minute consultation to see how I can support your relationship and financial goals.

The Risks of Keeping Your Money Separate

Research on engaged and first-time married couples consistently shows that fully pooling finances over time is associated with greater relationship satisfaction and happiness. Shared money tends to reinforce a sense of “we” rather than “me,” especially when couples are aligned on goals.

Problems arise when separate accounts become a substitute for communication. Without shared visibility and regular conversations, financial independence can quietly drift farther away. Protection can be misread as secrecy. Independence can be mistaken for avoidance.

We hosted the author of the research on a past episode of the Modern Husbands Podcast.

Generational Shifts in Money Norms

Younger couples are more likely to experiment with hybrid systems, and that trend reflects broader social changes rather than declining commitment.

Many marry later, after years of managing finances independently. They are more likely to have two high incomes and to value equality in financial decision-making. They are also more likely to enter relationships with debt, established spending habits, and clear expectations around autonomy.

For these couples, combining everything immediately may feel less like teamwork and more like erasing personal context. Hybrid systems offer a way to ease into financial integration rather than rushing it.

The Rise of Hybrid Financial Systems

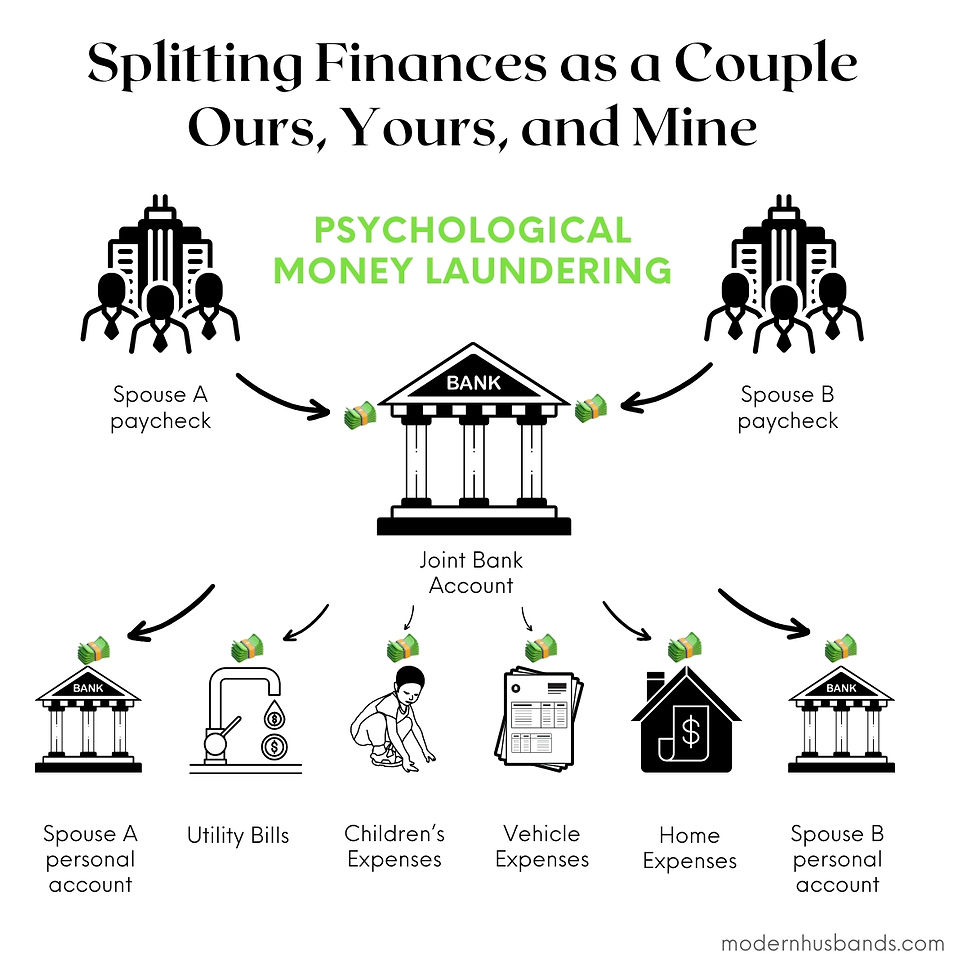

Most couples who move away from fully joint finances are not abandoning shared money altogether. Instead, they are adopting hybrid systems that combine joint and individual accounts.

In these setups, couples typically use a joint account for shared expenses like housing, utilities, childcare, and savings goals, while keeping separate accounts for discretionary spending. This structure has become more common as couples marry later in life, bring more established financial histories into their relationships, and maintain two incomes rather than a single primary earner.

Debt is a major factor. Student loans, credit card balances, or financial obligations from earlier stages of life do not disappear when a relationship becomes serious. For many couples, hybrid systems feel more realistic than pretending those histories no longer exist.

Flexibility also plays a role. Dual-career couples often want autonomy alongside partnership. Separate accounts can offer breathing room without undermining shared responsibility.

In my previous post, How to Split Your Finances: Ours, Yours, and Mine, I went into detail about how to use the Ours, Yours, and Mine approach and developed helpful graphics to illustrate the key points.

Why Timing and Conversation Matter

Money conversations should start early and be revisited often. Ideally, couples talk before moving in together, before engagement, and before major purchases. They also revisit these conversations as circumstances change, such as career shifts, children, or paying off debt.

Personal financial history plays a powerful role here. Experiences with scarcity, debt, or financial control shape how safe someone feels combining money. When couples do not share those histories, assumptions fill the gap. One partner may see separation as responsible self-protection. The other may see it as a lack of trust.

Those misunderstandings can harden into resentment if left unspoken, which is why I created a free downloadable set of Money Date cards found in my past post, What is a Money Date?

The Real Takeaway for Couples

There is no single “correct” way for couples to structure their finances. Joint accounts are not inherently more loving, and separate accounts are not inherently more distant.

What builds trust and happiness is intentionality. Couples who align on goals, understand each other’s financial histories, and revisit their systems as life evolves tend to fare better regardless of how many accounts they have.