7 End of Year Financial Tasks to Strengthen Your Finances Before January

- Brian Page

- Dec 8

- 4 min read

As the year winds down, most of us are focused on holiday plans, family logistics, and trying to wrap up work without burning out. But the end of the year is also one of the most important moments for your financial health. A few intentional steps now can save you money, reduce stress, and set you and your spouse up for a smoother, more confident start to the year ahead.

These seven tasks are simple, practical, and take less time than assembling a toy on Christmas morning, but they each carry a big payoff.

Here is your end of year financial checklist to tackle together.

1. FSA Funds: Use Them or Lose Them

A Flexible Spending Account (FSA) is one of those benefits that sounds great in theory but quietly causes stress when December arrives. Unlike an HSA, FSA dollars generally expire at the end of the year unless your employer offers a grace period or small rollover.

Most plans allow you to carry over up to $660, anything above that disappears.

This is the moment to log in, check your balance, and make a plan. If you still have funds left:

Order prescription glasses or contacts

Stock up on eligible over the counter medications

Schedule dental or vision appointments

Grab first aid or wellness supplies for next year

Click here for more details about an FSA.

2. Check Your Tax Withholdings (Especially if You Got Married)

Life changes should trigger tax changes, but most people forget to update their W 4 until spring, when it is too late.

Ask yourself:

Did you get married this year?

Did you owe taxes last April?

Did you adjust your withholdings after a promotion?

End of year is the perfect time to fix any under withholding before the IRS finds you in a surprise you did not order. Pull up your most recent pay stub and compare it against your 2024 taxes. Adjusting now can prevent an unexpected bill or help you avoid giving the government an interest free loan.

Couples benefit most when they review this together. Marriage can change your tax bracket, deductions, and how your withholding should be structured. A five minute update now beats a panicked scramble later.

Click here and use the IRS Withholding Calculator.

3. Pay Yourself First: Raise Your Savings When Your Income Rises

If you received a raise this year, a quick question: Did your savings increase too?

For most households, the answer is no thanks to lifestyle creep. Increases in income quietly turn into increases in spending unless you intentionally capture the difference.

End of year is the ideal moment to reset your automatic transfers:

Adjust your savings rate in your employer retirement plan

Increase automatic transfers to your emergency fund

Boost contributions to short term savings buckets (travel, home repairs, kids activities)

Even a 1 percent increase has a meaningful compounding effect. Couples who pay themselves first build wealth more steadily and experience lower money related stress.

Pro Tip: Split your savings into a high yield savings account at a different financial institution than where your spending money is deposited – out of sight, out of mind!

4. Retirement Update: Higher 401(k) Contribution Limits for 2026

Planning ahead matters, especially for dual career couples trying to maximize tax advantaged savings. Beginning in 2026, the maximum employee contribution to a 401(k) rises to $24,500, up from $23,500 in 2025 for those under age 50.

Why pay attention now?

Because contribution increases often require adjusting payroll elections early in the year. If you want to stay on track or catch up, review your current contribution percentage and determine what you will need to change in January.

Even if you are not maxing out, this is a great moment to discuss retirement goals as a couple. Are you on the same page? Are you saving enough to give your future selves choices? Moments like this help keep both partners aligned.

Pro Tip: Read The Hidden Cost of Not Talking About Money: Why 1 in 4 Couples Lose Out on Retirement Savings

5. HSA Boost: Contribution Limits Rising to $8,750

If you are enrolled in a high deductible health plan and have access to a Health Savings Account (HSA), good news: the 2026 contribution limit for family coverage increases to $8,750 for those under 55.

HSAs offer a triple tax advantage: tax deductible contributions, tax free growth, and tax free withdrawals for qualified medical expenses. They are also one of the most flexible accounts because you can invest unused funds and treat them like a stealth retirement account for future medical costs.

Review your current contribution level and decide whether you want to increase it for the upcoming year.

6. Pull Your Annual Credit Report

Checking your credit report is like checking the smoke detectors, essential, easy to forget, and potentially lifesaving. Every consumer is entitled to a free credit report each year from AnnualCreditReport.com.

Look for:

Accounts you do not recognize

Incorrect balances

Missed payments reported in error

Signs of identity theft

Catching issues now gives you time to dispute mistakes before you are applying for a mortgage, refinancing a loan, or shopping for new insurance quotes.

7. Make Charitable Gifts Before December 31

If you plan to donate, doing so before the ball drops means the contribution counts for this tax year.

More importantly, giving together is powerful relationally. It sparks conversations about values, priorities, and the kind of impact you want to make as a couple. Whether you donate money, goods, or volunteer time, year end is a moment to be intentional.

Start the New Year from a Place of Strength

Tackling these seven tasks will not just improve your finances, it will reduce stress and help your marriage feel more coordinated, more proactive, and more aligned. And if you and your partner struggle talking about money, use some of the tips I share in What is a Money Date?

You do not need to do everything perfectly. Just pick a couple of items to complete this week. A few small steps now make a big difference later.

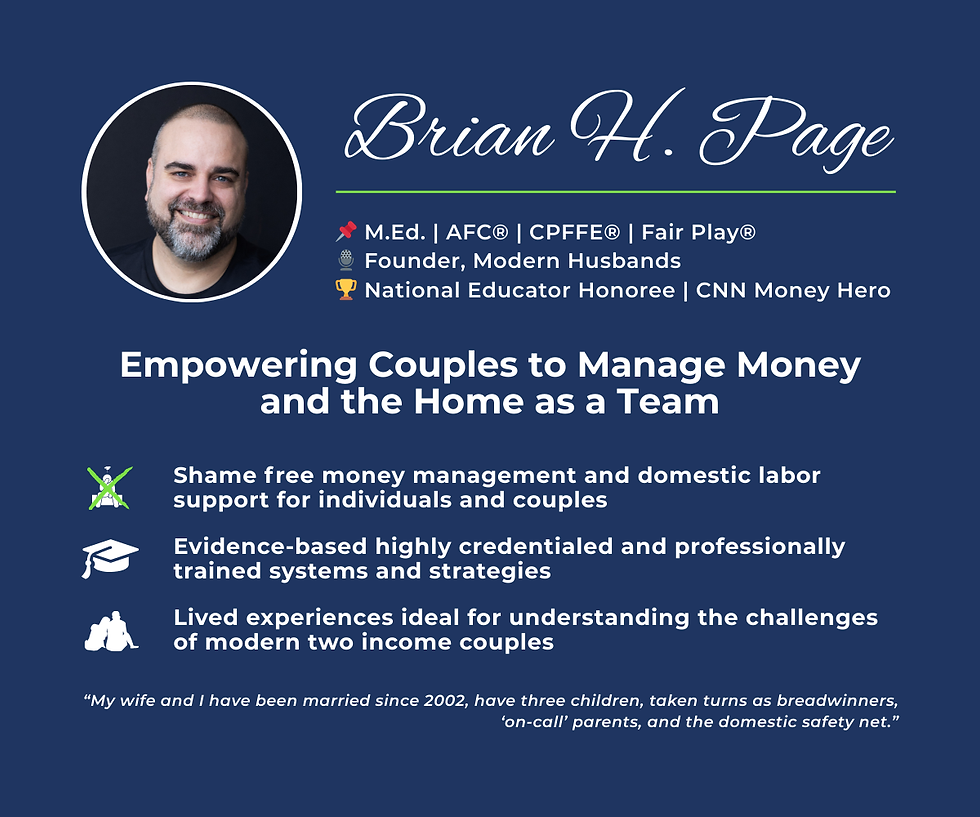

Professional Support

I'm the only professional in the nation certified as both a Fair Play® Domestic Labor Specialist and an Accredited Financial Counselor® (AFC®), and I've lived what I teach. I'd love to chat if you think I can help you. Book your free 15 minute exploratory call today.