No Spend January: Why It Feels Impossible for Parents (And What to Do Instead)

- Brian Page

- 3 days ago

- 4 min read

Every January, social media is filled with bold promises of resetting your finances with "No Spend January." Undo the damage of the holidays. Take control.

You cannot “No Spend” your way out of child care, rent, health insurance, groceries, or medical bills. Those costs do not pause just because the calendar flipped.

This isn't news to the millions of folks who are rolling their eyes at the $1,000 Trump account news, while the cost to live is so high that women are leaving the workforce at record rates; among the women who left their jobs, 42% identified caregiving responsibilities, including the cost of childcare.

Interact with FinMango's Financial Health Barometer for a data driven sense of how bad it is in your state.

Why No Spend Advice Was Not Built for Parents

No Spend January works best for people whose budgets are mostly discretionary. Fewer meals out. Fewer impulse buys. Fewer online orders.

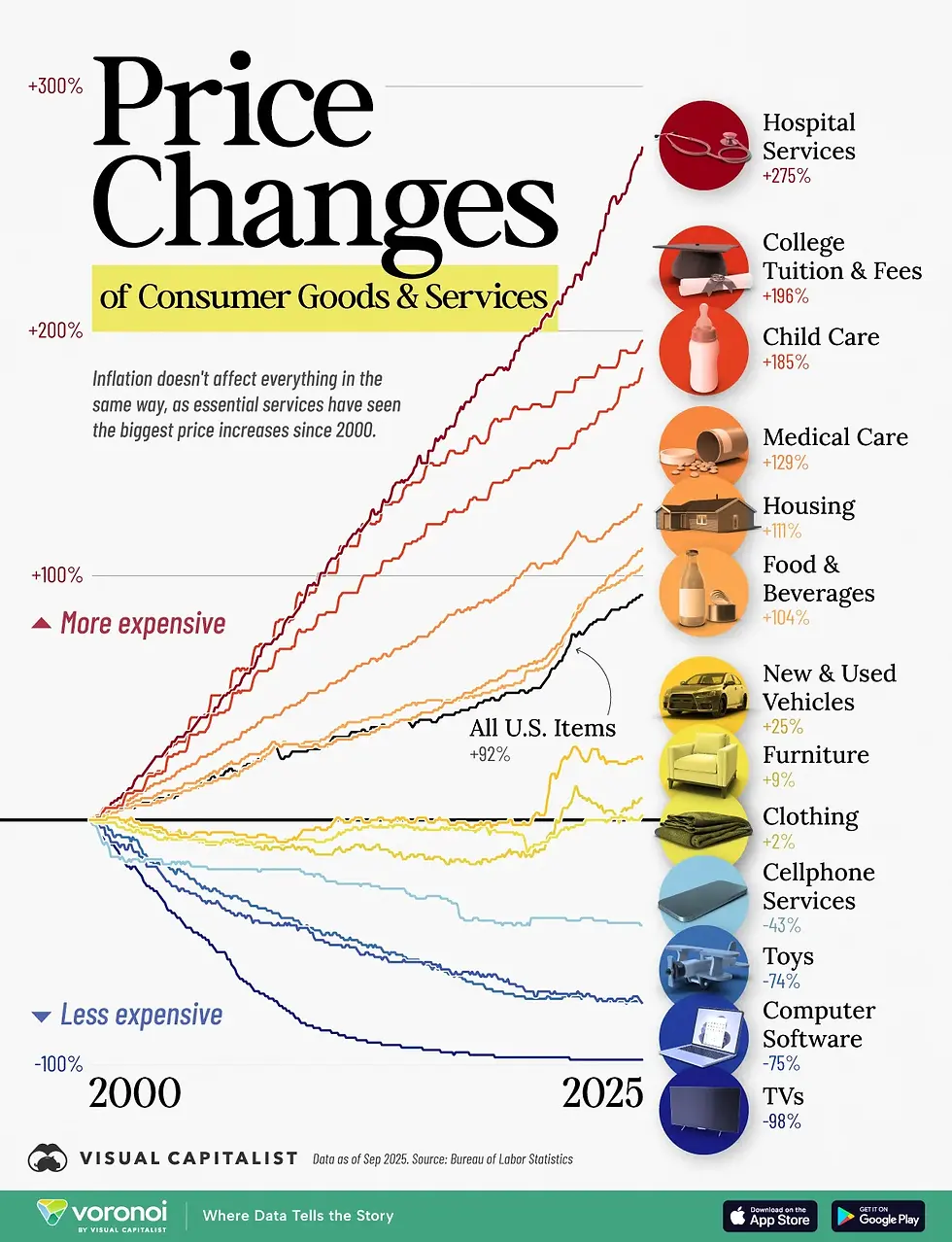

Most parents do not live in that world. The fastest rising costs over the last two decades have been child care, housing, health care, and food. These are fixed, recurring, and unavoidable. They show up whether your credit card is locked or not.

When parents attempt a “no spend month,” one of two things usually happens. Either essentials continue quietly in the background, or spending stress shifts onto one partner who is still managing the household system.

That is where money stress turns into relationship stress. Research has found that being the family's money manager is very stressful, and placing unrealistic expectations on that person will make the problem worse.

The mental load of money management is the invisible planning and tracking that keeps family life running. When spending rules are vague or unrealistic, the mental load often increases for one partner, usually the one already managing logistics.

What No Spend January Actually Looks Like at Home

In many households, No Spend January creates confusion. Bills still get paid. Groceries still get bought. Kids still need things. But now every small purchase feels loaded. Coffee becomes a debate. A quick takeout night becomes a silent judgment.

The tension is not really about the money. It is about unclear expectations and uneven ownership. One partner thinks the goal is strict deprivation. The other thinks the goal is survival. Neither feels supported.

And as you can see below, No Spend January is a surging trend.

Image Created By Charttr

Alternatives to No Spend January

Absent political reforms that address the real world affordability crisis, here are four alternatives to "No Spend January."

The Reframe Parents Actually Need: No Surprise Months

For families, a better goal than No Spend January is a no-surprise month. A no-surprise month focuses on predictability instead of punishment. The goal is not to spend nothing. The goal is to know what is coming and agree on it in advance.

That means fewer unexpected charges, fewer last-minute scrambles, and fewer moments where one partner feels blindsided. "No-surprise months" reduce resentment by replacing guesswork with shared clarity.

Related: Join our newsletter subscribers for ideas to manage money and the home as a team.

Think Annual Planning, Not Monthly Deprivation

January often fails because it tries to solve a twelve-month problem in thirty days. Families benefit more from annual planning than from short-term restrictions. Child care contracts, insurance premiums, deductibles, school costs, activities, and medical cycles all operate on yearly timelines.

When couples zoom out and map these costs together, January stops feeling like damage control and starts feeling like preparation.

This is where monthly money dates become powerful. Instead of policing spending, couples review what is coming, what changed, and what needs attention next.

Minimize Big Fixed Costs

Most financial stress in families comes from large fixed decisions, not daily purchases.

Housing. Child care. Transportation. Insurance. These categories quietly dominate the budget, yet couples often spend more energy debating small discretionary items.

Agree upon and minimize every big fixed cost in your relationship. When both partners agree on the big commitments, small spending becomes less emotionally charged. The system feels fairer, even when money feels tight.

Where January Can Actually Help: Recurring Costs

January is a great time to be diligent about one thing. Recurring expenses. Subscriptions, apps, services, and memberships tend to grow quietly. They add stress without adding value.

Canceling or right-sizing recurring costs creates permanent relief, not temporary sacrifice.

This is why subscription audits are far more effective than no-spend challenges for parents. You remove friction from every month going forward.

If you want a practical starting point, this guide walks through how to find and fix sneaky recurring costs.

The Real Win Is Not Spending Less

The real win is not spending less for thirty days. It is building systems that reduce impulsive and automatic spending throughout the year.

Strong marriages are built on shared expectations, clear ownership, and fewer surprises. January is a great time to build those systems, not punish yourselves for living real lives.

Professional Support

If one of you is carrying more of the financial stress, or if money is a source of tension in your relationship, you don't have to figure it out alone.

As the only Accredited Financial Counselor®, Certified Financial Therapist™, and Fair Play Facilitator® in the country, I work with couples to help them manage money and the home as a team. That means looking beyond the numbers. It means digging into the roles, expectations, and habits that shape your financial life and creating a plan that works for both of you.

Let's stop letting money pull you apart. Let's start using it to bring you closer together.

➡️ Book a free 15-minute consultation to see how I can support your relationship and financial goals.