Maximizing Your Savings with Raisin: A Financial Game-Changer

- Brian Page

- Nov 8, 2023

- 7 min read

Updated: Jan 21, 2024

Table of Contents

Why Raisin is the Platform to Find Your Savings Account: By the Numbers

We do our primary banking at Chase. However, the savings rates at Chase and other banks their size could be better, so we recently started using Raisin for our emergency savings.

Let's start with what our search looked like in finding the savings products that offered us the most generous interest rates.

A picture can be worth a thousand words. So, rather than just telling you why Raisin is the nation's best tool for finding the highest savings account yields, I will show you. I then created basic comparison charts to make it easy for you to compare accounts.

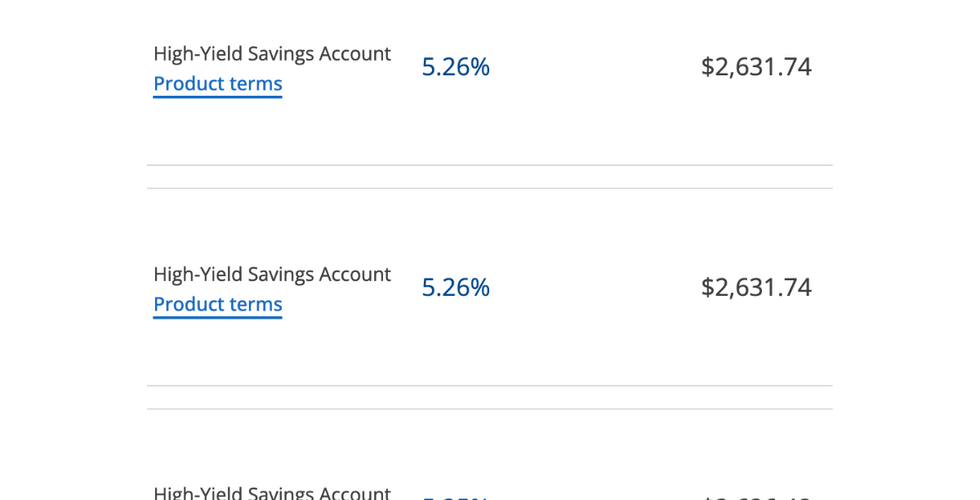

You will find screenshots comparing savings accounts offered through Raisin, Bank of America, and Chase. Feel free to expand your search to include other big or online banks. Use the arrows to slide through the three to compare. Remember that the higher the APY%, the better for the saver.

Assume $50,000 in the savings account. Here is how they compare, dollar for dollar:

Below, you will find screenshots comparing certificates of deposits offered through Raisin, Bank of America, and Chase. Use the arrows to slide through the three to compare. Remember that the higher the APY%, the better for the saver.

Assume a $50,000 certificate of deposit. Here is how they compare, dollar for dollar:

What is Raisin?

Raisin is a leading financial savings platform that connects users with a wide range of FDIC insured community banks and NCUA insured credit unions across the United States.

The platform acts as a one-stop-shop for savers, providing access to competitive interest rates and deposit products from various partner banks and credit unions. With a user-friendly interface and a seamless registration process, Raisin offers a convenient way to grow your savings without the hassle of dealing with multiple banks and credit unions individually.

Why our Family Uses Raisin

Access to Exclusive Offers

One of the standout features of Raisin is its ability to provide users with access to exclusive savings products and higher interest rates that may not be readily available through traditional banking channels. By partnering with a diverse network of community banks and credit unions, Raisin offers an array of deposit options with the country's most competitive interest rates and yields.

Diversification of Deposits

Raisin allows users to diversify their savings across multiple community banks and credit unions. This diversification not only spreads risk but also allows you to take advantage of varying interest rates and terms, ultimately optimizing the return on your savings.

Transparency, Safety, and Security

With Raisin, transparency and security are paramount. The platform ensures that all partner banks meet rigorous regulatory standards, providing users with peace of mind knowing that their savings are held in institutions that adhere to strict financial regulations and guidelines. Raisin only works with banks that are FDIC insured and credit unions that are NCUA insured.

Streamlined Management

Managing your savings on Raisin is incredibly straightforward. You can open and manage deposits with multiple partner banks and credit unions through a single account, all from the comfort of your computer or mobile device. This eliminates the need for multiple logins and streamlines tracking your savings progress.

No Hidden Costs

Raisin is committed to transparency in its fee structure. There are no hidden costs associated with using the platform. Any fees or charges are clearly outlined, allowing users to make informed decisions about their savings strategy.

Comparing the Big Banks to Community Banks and Credit Unions

Community banks and credit unions often have more modest marketing budgets than their larger counterparts like Chase and Bank of America. While community banks and credit unions may lack the vast financial resources of the big banks, they make up for it with a more focused and community-centric approach to marketing and product offerings.

Large banks like Chase and Bank of America can deploy massive national or global marketing campaigns. They can invest in high-profile advertising, sponsorships, and technology-driven marketing strategies that can reach a broader audience.

However, at the time of writing this post, their savings products pale compared to what is offered by some of the community banks and credit unions that have partnered with Raisin.

Raisin offsets community banks and credit unions' modest marketing budgets by promoting them as a group through a savings selection tool that is simple and easy to use for folks like you and me.

What is a Community Bank?

A community bank is a financial institution that operates locally, typically serving a specific geographic area, such as a town, city, or region. Unlike large national or multinational banks, community banks are smaller in size and often have a more intimate understanding of the needs and challenges faced by the communities they serve.

Characteristics of community banks include:

Local Focus: Community banks are deeply rooted in their local communities. They often have a strong presence and active involvement in the areas they serve.

Personalized Service: They tend to offer their customers more personalized and tailored services. This can include personal attention from staff, customized financial solutions, and a more intimate understanding of individual and local business needs.

Relationship-Centric: Community banks prioritize building and maintaining strong relationships with their customers. This focus on relationships often leads to high customer satisfaction and loyalty.

Decision-Making Authority: Decisions regarding loans and financial services are often made locally by people familiar with the community and its economic landscape. This can lead to quicker decision-making processes.

Support for Local Economy: Community banks support the local economy by providing small businesses and individuals with loans. This can contribute to economic growth and stability in the community.

Risk Mitigation: Due to their close relationships with customers, community banks may have a more in-depth understanding of borrowers' creditworthiness, contributing to more prudent lending practices.

Range of Services: While community banks may not offer the same breadth of services as larger institutions, they still provide various financial products and services, including savings accounts, checking accounts, loans, mortgages, and more.

Regulation: Like all banks, community banks are regulated by government authorities to ensure they adhere to industry standards and maintain the safety and soundness of the financial system.

Community banks play a vital role in the economic well-being of the communities they serve. Their local focus, personalized service, and commitment to community development set them apart in the financial industry.

What is a Credit Union?

A credit union is a not-for-profit financial cooperative that is owned and operated by its members. Unlike traditional banks, which are owned by shareholders and aim to generate profits, credit unions exist to serve their members' financial needs. They are structured around a common bond, which can be based on factors such as employer affiliation, geographic location, or membership in a specific organization.

Characteristics of credit unions include:

Member Ownership: Members of a credit union are also its owners. Each member has a say in the credit union's operations and can vote on important decisions, such as the election of board members.

Not-for-Profit Structure: Credit unions are not-for-profit organizations. Any profits generated are typically reinvested into the credit union to benefit members through higher interest rates on savings accounts, lower interest rates on loans, and improved services.

Common Bond: Credit unions are formed around a common bond, which could be based on factors like employment, community affiliation, or membership in a specific organization. This common bond defines the eligibility criteria for membership.

Personalized Service: Credit unions are known for their personalized service. They often have a more intimate understanding of their members' financial situations and can provide customized solutions.

Lower Fees and Competitive Rates: Credit unions typically offer lower fees and competitive interest rates on loans and savings accounts due to their not-for-profit status. This can result in cost savings for their members.

Community Involvement: Many credit unions are actively involved in their local communities. They may sponsor community events, provide financial education, and support charitable causes.

Range of Services: While credit unions may not offer the same services as larger banks, they provide essential financial products such as savings accounts, checking accounts, loans, mortgages, and other financial services.

Regulation: Credit unions, like banks, are regulated by government authorities to ensure they operate within legal and financial guidelines, safeguarding the interests of their members.

Credit unions play a vital role in the financial industry by providing an alternative to traditional banking institutions. Their member-focused approach, commitment to community, and emphasis on financial education make them popular for individuals seeking a more personalized and community-oriented banking experience.

Criteria for Selecting Your Savings Account

Save Safely

Credit Union Savings Products

Confirm that the account you open is insured by the NCUA. Share insurance covers many types of share deposits received at a federally insured credit union, including deposits in a share draft account, share savings account, or time deposit such as a share certificate.

Share insurance covers members' accounts at each federally insured credit union, dollar-for-dollar, including principal and any accrued dividend through the date of the insured credit union’s closing, up to the insurance limit. This coverage also applies to nonmember deposits when permitted by law.

Click here to learn more.

Bank Savings Products

FDIC deposit insurance protects money you hold at an FDIC-insured bank in traditional deposit accounts like:

Checking accounts,

Savings accounts,

Money market deposit accounts (MMDAs), and

Certificates of deposit (CDs).

Coverage is automatic when you open one of these types of accounts at an FDIC-insured bank.

Click here to learn more.

Avoid Fees

Check if the account has a monthly maintenance fee. If it does, see if you can get it waived.

Get a copy of the account's fee schedule (a list of fees the account charges) and look at what the bank could charge you. Make sure you're comfortable with these amounts before applying for the account.