Your New Year’s Resolution Money Goals That Will Stick

- Brian Page

- Dec 30, 2025

- 5 min read

Updated: Jan 2

Every January, millions of couples set financial resolutions with the best intentions. Save more. Spend less. Pay off debt. Create a budget. Feel more in control.

Most of these resolutions collapse by February. Not because couples are lazy or undisciplined, but because the resolution depends on motivation, which always fades. A resolution that sticks needs a ritual behind it, a system that pulls you back into conversation even when life becomes chaotic.

If you want a New Year’s money goal that truly lasts, commit to one thing:

Schedule recurring Money Dates with your partner.

Once it is scheduled on your shared family calendar, it becomes a habit. Once it becomes a habit, your entire financial life becomes more intentional, more transparent, and far less stressful.

This one practice changes everything.

Why Money Dates Work

A Money Date is a scheduled conversation between you and your spouse in a comfortable, relaxed environment where you talk openly about your relationship with money, your shared goals, and the real emotions that shape your financial decisions.

Some couples call this a household business meeting. Others treat it like a check in or a planning session. What you call it does not matter as much as the goal: to ensure both partners understand and participate in financial decision making.

Most couples talk about money only when something goes wrong, like a surprise bill or a disagreement about spending. But the best time to talk about money is when emotions are low and you can think clearly as a team. A Money Date protects your relationship from the stress of reacting to financial problems and instead builds a proactive rhythm.

Choose a calm time. Some couples go for a walk. Others meet on the couch when the kids are out. What matters is that the conversation is scheduled, uninterrupted, and grounded in good intentions.

Why Talking About Money Can Feel Hard

Money is not just numbers. It is your childhood, your fears, your identity, and your sense of security. Behind every financial behavior, there is a story.

Your Money Date may include emotions such as anxiety, frustration, guilt, or even excitement. Some people feel ashamed about past financial mistakes. Others avoid money discussions because managing finances feels overwhelming. And for many couples, income is an emotional topic. Research shows husbands often feel stress tied to being the primary earner, and that stress rises when wives earn more than 40 percent of the household income.

This means money conversations require patience, empathy, and curiosity. You are not just reviewing numbers. You are learning each other’s internal worlds.

If the conversation becomes overwhelming, pause. Return to it later. Offer each other grace. Remember that more income should never mean more control. A healthy financial partnership is rooted in equality and trust.

Start Your Money Date With Something Fun

Before diving into budgets or bills, begin by asking each other:

What do you enjoy spending money on the most?

This sets a positive tone and helps you both connect money to happiness, not deprivation.

Another great opening is a Lottery Date. Buy a small lottery ticket and ask:

If we won five million dollars, what would we do?

Would you buy a house, travel more, cut back on work, donate to causes, spend more time with family, or change careers?

These answers reveal your core values. They help you understand what matters most to each other and help you guide future financial decisions.

Work Through the Emotions Behind the Numbers

After the initial questions, explore more reflective prompts during your Money Dates, such as:

Do you believe money can reduce stress or increase happiness to a certain degree? What amount would make you feel secure?

This helps you identify each partner’s sense of financial safety and the role money plays in career decisions, time with family, and long term goals.

Do you enjoy aspects of managing money such as paying bills, investing, or tracking expenses? What do you dislike?

Dividing responsibilities by preference and skill, not by gender or default roles, creates a fairer system. One person might handle investments and insurance while the other manages day to day bill payments. Or one partner may manage everything but only after goals are decided together.

Honesty is essential. Research shows that two in five couples commit financial infidelity, and one in ten lie about their income. Transparency during Money Dates builds trust and protects your marriage from the strain of secrecy.

Your Annual Financial Checklist for Couples

A Money Date is the perfect place to work through your annual financial review. Below is a clear, structured checklist you and your spouse can discuss together. You do not need to cover everything in one meeting. Spread items across your monthly dates so y'all don't get overwhelmed.

I created these checklists for our Move Your Marriage WeTreat. As I explained there, you do not need to complete this entire checklist in January. Spread these topics across your monthly Money Dates and you will stay financially aligned throughout the entire year.

The System That Makes Your Resolution Stick

The most important step is to schedule your time. A repeating calendar event ensures you keep showing up even when life becomes busy. It removes the mental load of remembering and makes your financial partnership predictable and fair.

Here is how to start:

Open your shared calendar

Create a recurring event titled Monthly Money Date

Add a simple agenda

Wins and challenges this month

Progress toward shared goals

One values based question

One checklist item to work through

Commit to honoring the appointment

Your New Year’s Resolution, Reinvented

Financial success is not about spreadsheets. It is about alignment. Connection. Honesty. And shared purpose.

When you talk about money regularly, without shame or pressure, everything else becomes easier. You start managing money as a team instead of reacting to stress alone. You set goals you both believe in. And you replace financial confusion with clarity and confidence.

Make this the year your money resolution sticks.

Not because you worked harder, but because you worked together.

Professional Support

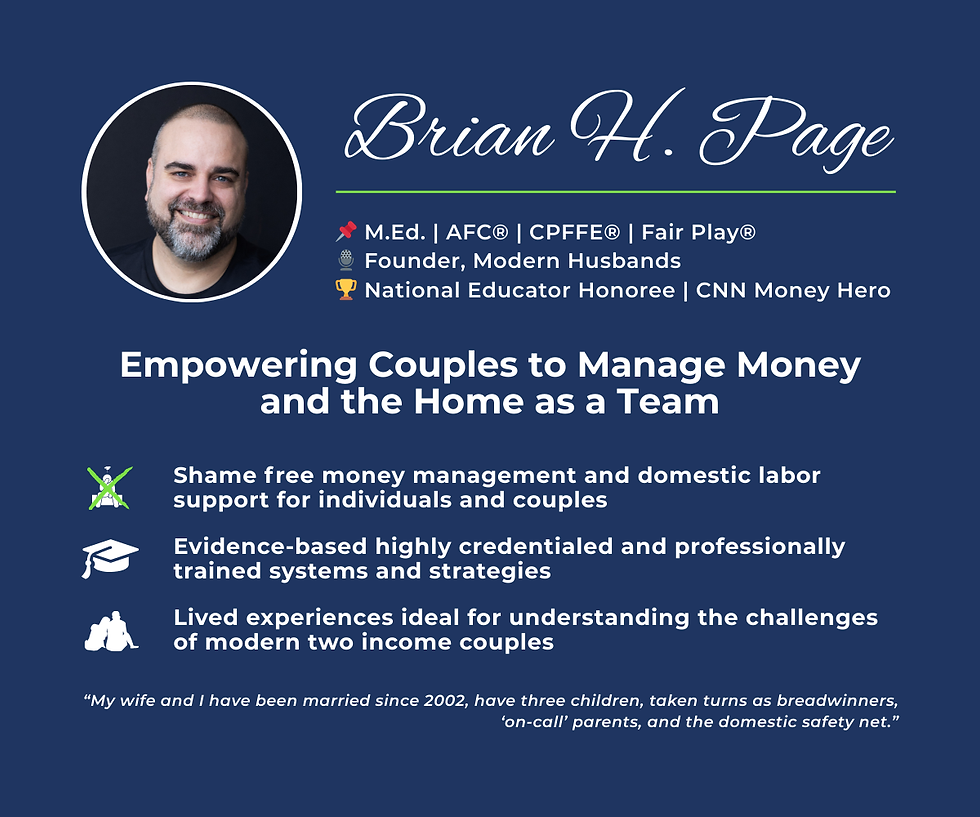

I support couples who want to better manage money or the home as a team in their relationship. I am also available for group coaching events.

I'm the only Accredited Financial Counselor® and Fair Play Facilitator®, empowering high-achieving couples with systems to manage money and the home as a team — drawn from decades of national leadership and lived experience.

Click here to schedule a free 15 minute exploratory call.

For more ideas to manage money and the home as a team in your marriage, click here to take advantage of our free preview of our Marriage Toolkit.