5 Mistakes To Avoid When Talking About Money

- Brian Page

- Mar 19, 2024

- 4 min read

Money conversations with your spouse can be a delicate dance, often fraught with tension, misunderstanding, and conflict. Yet, effective communication about finances is essential for building a strong foundation of trust and unity in your relationship.

In this post, we'll explore five mistakes to avoid when discussing money with your partner and what to do instead.

1. Choosing the Wrong Time

Money discussions are often laden with emotion, anxiety, and even taboo. Bringing up money at the wrong time can adversely affect your finances and relationships. For example, discussing money while multi-switching between tasks or commitments.

Stress, fatigue, or emotional exhaustion can exacerbate tensions and lead to irrational decisions when discussing money. Anger, frustration, and anxiety can cloud judgment and hinder productive dialogue.

Discussing money at an inopportune time, such as a crisis or while emotionally responding to an issue, may cause defensiveness or resistance. When people are preoccupied with other pressing matters, discussing money can lead to misunderstandings, miscommunications, and overlooked details.

How to choose the right time

All parties are calm and receptive to talking about money.

Your conversation will be free of interruptions.

Everyone is open-minded and committed to listening.

You have scheduled regular times to talk about money.

2. Failing to Use Active Listening Skills

Active listening is more than simply hearing words; it is about fully understanding the message. Failing to use active listening skills can result in misunderstandings or incomplete information. Each partner may have their perspective, concerns, and priorities regarding financial matters.

Active listening fosters empathy and trust by demonstrating genuine interest in what the other person says. Failing to do so may lead to feelings of dismissiveness or invalidation, eroding trust and hindering communication. Individuals may also misunderstand each other's intentions if they don't use active listening skills, leading to unrealistic expectations or unnecessary conflicts.

For shared goals, values, and priorities to be identified, active listening is essential. Without it, discussions can devolve into power struggles or stalemates, impeding progress and preventing mutually beneficial outcomes.

Active listening empowers individuals to engage in constructive dialogue, brainstorm ideas, and explore alternative solutions, which is needed to avoid one-sided conversations dominated by preconceived notions.

Active listening tips (according to the Cleveland Clinic)

Set an intention

Mindful presence

Ask questions

Don’t focus on your response

Be nonjudgmental

Your body posture tells a story

Take notes

Click here to read the details beyond each strategy, shared by the Cleveland Clinic.

3. Being Judgmental

While it may seem harmless, being judgmental when discussing money can have significant negative consequences on the relationship and each individual's financial well-being. It can undermine trust and transparency because spouses may be less inclined to be transparent about their financial situation. And this lack of openness can lead to misunderstandings, resentment, and, ultimately, a breakdown in trust.

Being judgmental amplifies the tension that often comes with talking about money by adding a layer of criticism and blame. Instead of working together to find solutions, spouses may become defensive or withdraw from the conversation altogether.

Judgmental attitudes towards financial decisions or behaviors can fuel resentment and shame in your spouse. Constant criticism or disapproval can make them feel inadequate or unworthy, damaging their self-esteem and confidence.

I’ve never heard a better explanation of how being judgmental with your partner can manifest into financial infidelity than from Dr. Thomas of the University of Georgia in the clip above.

The preceding clip is an example of what is included in the Transition to Marriage Toolkit.

How not be judgmental

4. Believing Financial Worth = Self Worth

Money and masculinity have been married for years. It's imprinted in the minds of all genders, and it can impact how we measure ourselves and our spouses.

There's no winning when you do this.

If you're struggling financially, your challenges are compounded by a bruised self-esteem. Men are especially likely to feel this way.

"If your financial success triggers a belief that you're better than others, then you're just an asshole."

Focus on your true self-worth

Find your self-worth in your humanity: how you love and love others. The spouse and parent you are each day. The child, the sibling, and the friend. All those you care for whose happiness you value. You can control these things, and they are the things that matter most.

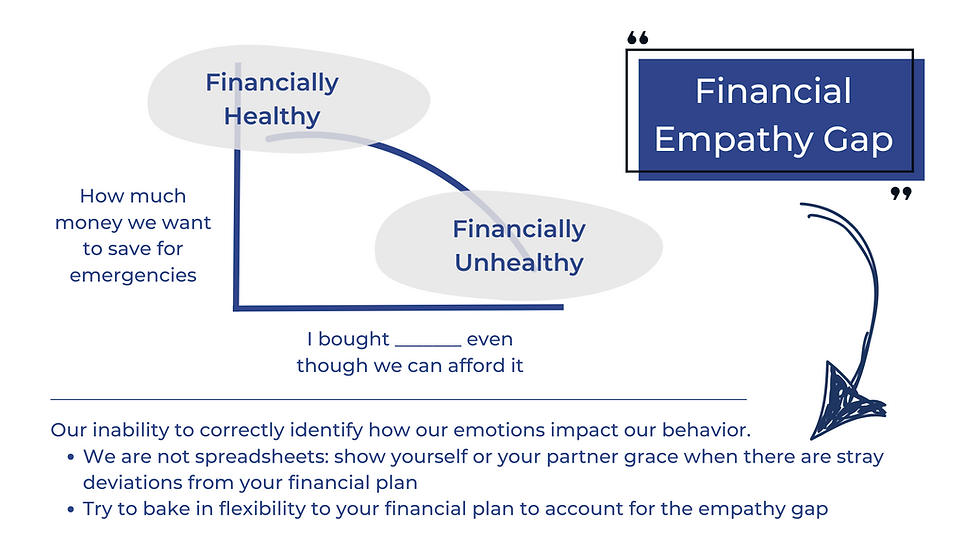

5. Failing to Give Grace

Giving grace, in its essence, means extending kindness, forgiveness, and empathy to oneself and others, particularly in moments of imperfection or difficulty. It's about offering a space free from harsh judgment and criticism, allowing room for growth, acceptance, and healing.

Giving grace includes accepting ourselves with all our flaws, mistakes, and vulnerabilities. You can't give yourself or anyone else grace if you believe perfection is a realistic standard, nor can you learn from your mistakes.

Grace is about forgiveness—releasing resentment and bitterness and embracing reconciliation and healing. It acknowledges that people make mistakes, but those mistakes don't define their worth or potential.

Give yourself and your partner grace

When you find it in your heart to give grace to yourself and your partner, you can begin to view financial mistakes as opportunities for learning and development, cultivating connection and empathy in our relationships.

Learn More

Couples who learn more, save more, and spend more on what is important to them.

For engaged and recently married couples who want to manage money and the home as a team.

Winning ideas from experts to manage money and the home as a team. 2023 Plutus Award Finalist: Best Couples or Family Content

🔔 Click here to listen and subscribe to the Modern Husbands Podcast on Apple.

🔔 Click here to listen and subscribe to the Modern Husbands Podcast on Spotify.

Winning ideas to manage money and the home as a team delivered to your inbox every two weeks. You'll even receive a few free gifts!