Financial Infidelity in Marriage: How to Move Forward Together

- Brian Page

- Nov 25, 2025

- 2 min read

Marriage is a partnership built on trust, love, and mutual respect. Financial deception and betrayal can erode or destroy that trust and create emotional distress and financial strain.

According to a recent Forbes Advisor Survey,

38% have lied to a partner about finances

54% say lying about finances is equivalent to other kinds of lying or infidelity

54% of Americans believe having a partner who’s in debt is a major reason to consider divorce

According to a NEFE survey,

“16% of respondents surveyed reported that financial infidelity ultimately led to divorce.”

What is financial infidelity?

Financial infidelity occurs when couples with combined finances lie to each other about money. Examples include hiding purchases, secret bank accounts, or undisclosed debts.

Why couples often commit financial infidelity

The reasons couples commit financial infidelity vary. Financial infidelity can occur because spouses do not agree on spending decisions, which often leads to unneeded arguments. According to the NEFE survey, other reasons couples commit financial infidelity include:

Some partners believe that some aspects of their financial lives should remain private.

Feelings of guilt or shame around a financial decision.

Lack of regular communication about money.

Systems to prevent financial infidelity

Michael Thomas, Ph.D., AFC®, CFT-I™, is a lecturer at the University of Georgia. Here’s a short clip of him suggesting how to address financial infidelity from our Marriage Toolkit.

Deciding how to move forward depends on many factors, and certainly, no one way is best for every couple. Most couples can address the leading factors that contribute to financial infidelity by communicating regularly about their finances on weekly money dates – dedicated times in a stress-free and judgment-free environment to discuss the family finances.

Couples who are financial opposites might consider the value of financial translucency by using the Yours, Mine, and Ours approach, which we elaborated on in our post How to Split Your Finances: Psychological Money Laundering.

Related: We use Tiller to keep our financial world automated and in one place. It is the perfect tool to make Money Dates go smoothly. Click here to learn more.

Consider Professional Support

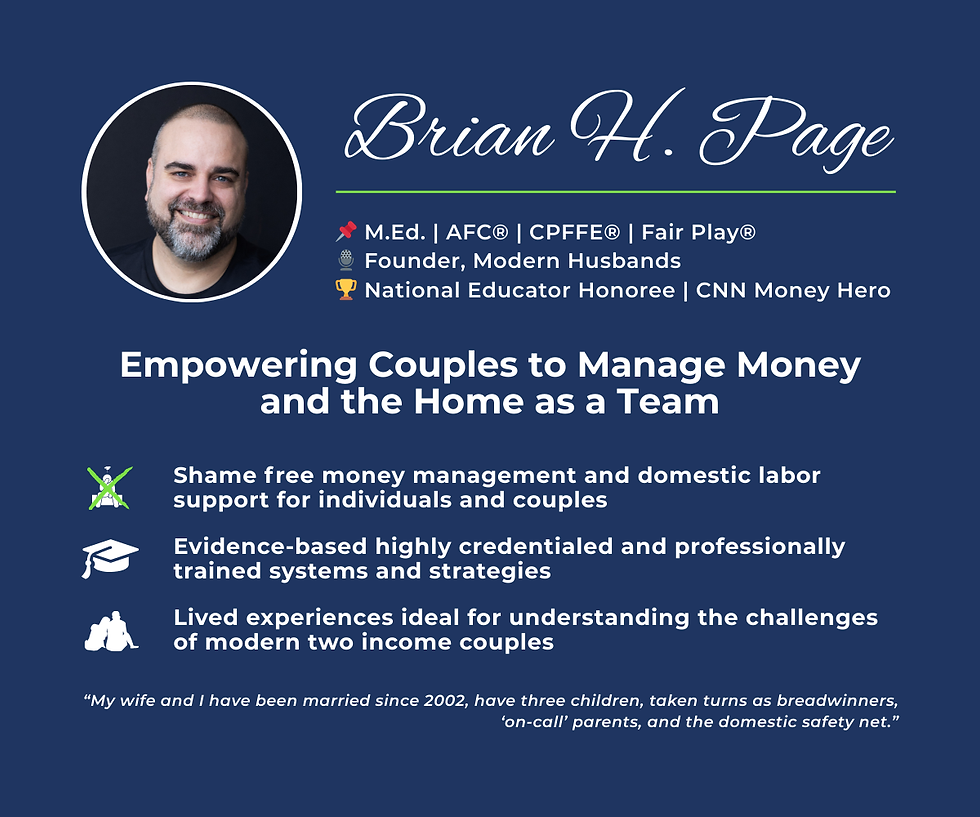

I help couples overcome the challenges surrounding financial infidelity. I'm the only Accredited Financial Counselor® and Fair Play Facilitator®, empowering high-achieving couples with systems to manage money and the home as a team — drawn from decades of national leadership and lived experience.

Click here to schedule a free 15 minute exploratory call.

For more ideas to manage money and the home as a team in your marriage, click here to take advantage of our free preview of our Marriage Toolkit.