How Should Money Be Split in a Marriage?

- Brian Page

- Aug 29, 2025

- 11 min read

Splitting Finances in Marriage

Money is one of the most common and contentious issues in marriage. How couples manage their finances can have a significant impact on their marital quality, stability, and satisfaction. One of the key decisions that couples face is how to split their money in a marriage.

Should they keep separate accounts, pool their resources, or use a combination of both?

Deciding how to move forward depends on many factors, and certainly there is no one way that is best for every couple. We will share with you insights based on academic research on how different ways of splitting money affect marriage.

New and Groundbreaking Research

Until this point, multiple studies found a correlation that couples who merge finances are happier than those who do not. In plain speak, this means that research could not prove that merging finances caused couples to be happier; it could only prove that couples who did merge their finances tended to be happier.

But now, there is clear evidence that married couples with joint bank accounts not only have better relationships but fight less over money and feel better about how household finances are handled.

One of the leading research authors was Dr. Jenny G. Olson, an Assistant Professor of Marketing at Indiana University's Kelley School of Business. Dr. Olson is also a Modern Husbands Advisory Board Member. We hosted Dr. Olson on the Modern Husbands Podcast to discuss the topic in depth.

Separate Accounts in Marriage

Some couples prefer to keep their money separate, meaning that each spouse has his or her own account and is responsible for his or her own expenses.

This approach may appeal to couples who value their independence, autonomy, and privacy. It may also reduce conflicts over spending habits, budgeting preferences, or financial goals.

However, keeping separate accounts may also have some drawbacks for marriage.

It may create a sense of distance or distrust between spouses, especially if they do not communicate openly about their financial situation. It may also create an imbalance of power or control if one spouse earns more or less than the other.

Furthermore, it may limit the ability of couples to achieve shared goals or cope with unexpected challenges that require joint resources.

Advantages to maintaining separate accounts in marriage

Autonomy and Independence

Separate accounts allow individuals to maintain a sense of financial autonomy and independence. It allows each spouse to have control over their own income, expenses, and financial decisions, fostering a sense of personal agency within the marriage.

Reduced Conflicts About Spending

Keeping separate accounts can help minimize disagreements and conflicts about how money is spent. There is evidence that for some, maintaining separate accounts reduces the likelihood of financial disagreements and promotes greater financial harmony within the relationship.

Flexibility and Individual Financial Goals

Maintaining separate accounts enables individuals to pursue their individual financial goals and priorities and use their money according to their own preferences, needs, and long-term objectives, promoting a sense of financial empowerment and personal fulfillment.

Greater Financial Privacy

Separate accounts provide a level of financial privacy, allowing individuals to keep certain financial matters personal, which can be beneficial when partners have different spending habits or financial responsibilities.

Disadvantages to Maintaining Separate Accounts in Marriage

Lack of Transparency and Trust

Maintaining separate accounts may lead to a lack of transparency in financial matters, which can undermine trust and communication within the relationship, potentially leading to arguments and unhappiness in the relationship.

Unequal Financial Contributions

Separate accounts can sometimes result in unequal financial contributions, particularly if one spouse earns significantly more than the other. This imbalance may create a sense of unfairness or resentment, as it can lead to disparities in financial responsibilities and decision-making power.

Limited Financial Teamwork

Keeping separate accounts may limit the opportunities for couples to work together as a team in managing their finances. Collaborative financial planning and goal setting become more challenging when financial resources are not pooled together, potentially hindering effective financial management.

Difficulty in Tracking and Coordination

Having separate accounts can make it more difficult to track overall financial status and coordinate household expenses which can lead to a lack of clarity about shared financial responsibilities and challenges in budgeting and financial planning.

Inefficiency and Duplication

Separate accounts may lead to duplication of efforts and increased complexity in financial management. This includes duplicate bank accounts, bill payments, and the need for additional communication and coordination between spouses, which can be time-consuming and inefficient.

Joint Accounts in Marriage

Some couples prefer to pool their money together, meaning that they have a common account and share all their income and expenses. Generally speaking, this approach is associated with higher levels of marital satisfaction and lower levels of divorce.

This approach may appeal to couples who value their interdependence, cooperation, and transparency. It may also foster a sense of teamwork and solidarity between spouses, especially if they have similar spending habits, budgeting preferences, or financial goals.

However, pooling money together may also have some drawbacks for marriage, such as a sense of loss or resentment for spouses who have to give up their individuality, freedom, or identity. It may also increase conflicts over spending decisions, budgeting strategies, or financial priorities.

Advantages to Joint Accounts in Marriage

Improved Financial Transparency and Trust

Joint accounts foster transparency as both spouses have access to the same financial information, promoting trust and openness in financial matters. This is important to mention because there is a positive association between financial transparency and relationship satisfaction.

Streamlined Financial Management

Having joint accounts can simplify financial management by consolidating income and expenses in a single account. It can facilitate budgeting, bill payments, and financial planning, as both spouses can actively participate in monitoring and managing shared finances.

Enhanced Shared Responsibility

Joint accounts encourage shared financial responsibility and a sense of partnership in managing finances. It allows both spouses to contribute to and have a stake in financial decisions, fostering collaboration and a joint sense of ownership over the couple's financial well-being.

Efficient Financial Planning

Joint accounts enable couples to work together in setting financial goals and making decisions that align with their shared objectives and values. Working together to manage money more often than not is associated with a more positive relationship.

Simplified Financial Communication

Joint accounts promote regular and open communication about finances. By sharing a common account, couples are more likely to engage in ongoing discussions about financial matters, facilitating effective communication, and minimizing misunderstandings or misalignments.

Related reading: How to Manage Money in Marriage

Disadvantages to Joint Accounts in Marriage

Loss of Financial Autonomy

Joint accounts may result in a loss of individual financial autonomy as both spouses have equal access and control over the shared funds. This loss of autonomy can lead to feelings of dependency or a perceived loss of personal financial freedom.

Conflicts Over Spending and Financial Decisions

Joint accounts can increase the potential for conflicts and disagreements over spending habits and financial decisions. Disagreements over money management are more likely to occur in relationships with joint accounts, which can strain the marital relationship.

Financial Risks and Liability

Joint accounts can expose both spouses to financial risks and liabilities. If one partner mismanages the funds, accrues debt, or becomes involved in legal issues, it can impact the other partner's financial well-being.

Lack of Privacy and Personal space

Joint accounts may compromise privacy and personal space, as both partners have access to detailed financial transactions and information. This lack of privacy can potentially lead to discomfort or a sense of intrusion into personal financial matters.

Related: Subscribe to our free newsletter for ideas to manage money and the home sent to your inbox every couple of weeks.

Combination of Both Strategies

Using a hybrid approach, often referred to as the “Yours, Mine, and Ours” method, is the use of a combination of both separate and joint accounts, meaning that they have a common account for shared expenses and individual accounts for personal expenses.

This approach may appeal to couples who want to balance their independence and interdependence, their cooperation and autonomy, and their transparency and privacy. It may also allow couples to adapt to different situations and needs that require different levels of financial integration or separation.

However, using a combination of both separate and joint accounts may also have some drawbacks for marriage that can create tension or dissatisfaction if spouses disagree on how much money to contribute to the common account or how much to keep for themselves.

It is not uncommon for couples to maintain joint accounts for most of their money, and use personal accounts for minor spending choices where there is a strong disagreement of how those dollars should be spent.

Advantages to Married Couples Having Joint and Shared Accounts

Financial Autonomy and Personal Spending

Maintaining separate accounts allows individuals to have financial autonomy and discretion over personal spending. It recognizes the importance of individual preferences and personal financial goals within the marriage, promoting a sense of independence.

Shared Financial Responsibilities

Joint accounts facilitate the pooling of resources and joint decision-making for shared expenses such as household bills, mortgage payments, or child-related expenses. It promotes a sense of collective responsibility and collaborative financial management within the relationship.

Transparency and Visibility

Joint accounts provide transparency and visibility into the overall financial picture of the household. It allows both partners to have access to the combined financial resources, promoting open communication and a shared understanding of the financial situation.

Flexibility and Customization

A combination of separate and joint accounts offers flexibility and customization in managing finances. Couples can tailor their approach based on individual circumstances and preferences, allocating funds for joint goals while maintaining personal accounts for discretionary spending or individual savings.

Financial Planning and Goal Alignment

Joint accounts facilitate joint financial planning and goal alignment. Couples can collaborate in setting shared financial objectives, such as saving for a house or retirement, while maintaining individual accounts to work towards personal goals.

This approach promotes a balance between shared aspirations and individual financial aspirations.

Disadvantages to Married Couples Having Joint and Shared Accounts

Complexity in Financial Management

Having a combination of separate and joint accounts can introduce complexity in financial management. Couples may need to navigate multiple accounts, transactions, and financial responsibilities, which can require additional time and effort to coordinate and track effectively.

Potential for Unequal Financial Contributions

Maintaining separate accounts alongside joint accounts can lead to disparities in financial contributions. If one spouse contributes more to joint expenses while maintaining significant personal funds, it may create a sense of inequality or resentment within the relationship.

Communication and Coordination Challenges

Balancing separate and joint accounts may require clear communication and coordination between partners. Inconsistencies or misunderstandings about financial responsibilities, spending, or contributions can lead to conflicts and strain the marital relationship.

Privacy Concerns

Combining separate and joint accounts may create potential privacy concerns. Partners may have access to both personal and shared financial information, which can lead to discomfort or the perception of intrusion into personal financial matters.

It is important to note that the disadvantages mentioned above are not inherent to the combination of separate and joint accounts but can arise due to potential challenges in managing both types of accounts simultaneously.

Open communication, mutual agreement, and regularly reassessing the arrangement can help mitigate these disadvantages and maintain a healthy financial dynamic within the relationship.

Couples from different class backgrounds, meaning one partner is from a blue-collar low to moderate-income family and the other from a high-income family, have often been found to have very different relationships with money. If pooling money into a joint account creates too many problems, the Yours, Mine, and Ours strategy could make the most sense.

We hosted a national expert on the subject, Dr. Streib of Duke University, to discuss the dynamics of cross-class backgrounds.

Modern Husbands Podcast

Guest: Dr. Streib of Duke University

Opposites Attract: Dr. Streib of Duke University explains the common challenges and solutions of spouses from different socioeconomic backgrounds.

Dr. Streib is an Associate Professor at Duke University and holds a PhD in Sociology from the University of Michigan. She is the author of three books. For this episode we focused on The Power of the Past: Understanding Cross-Class Marriages looks at how couples who grew up in different class backgrounds think about how to spend money, plan their careers, raise their children, and express their emotions.

Click here for the show notes.

Related: Learn more about the Modern Husband Podcast, the 2023 Plutus Award Finalist for Best Personal Finance Content for Couples or Families.

How Couples Should Manage Money Together

Money is an important aspect of marriage that can have both positive and negative effects on the relationship. How couples split their money in a marriage can reflect and affect their values, goals, expectations, and behaviors.

There is no one right way to split money in a marriage; different approaches may work better for different couples depending on their circumstances and preferences. But consider the latest research, Factors Associated with Couples Pooling their Finances:

Those who reported agreeing on issues related to spending were more than twice as likely to pool their finances as compared to those who did not agree with their partner on issues related to spending.

Couples must be aware of how splitting money affects their marriage and to take steps to find the best solution for them. Doing so is best done on a Money Date, using variations of the suggestions below.

Discuss your financial values, goals, and expectations with your spouse before and after marriage.

Choose a method of splitting money that suits your needs and preferences as a couple.

Review and revise your method of splitting money as your situation or needs change over time.

Communicate openly and respectfully with your spouse about your financial situation and decisions.

Seek professional help, such as with a Financial Therapist, if you have financial difficulties or conflicts.

Modern Husbands Podcast

Philip Olson's "Two Cents" on Managing Money in Marriage

A good place to turn for practical advice to manage money and the home as a couple is a podcast episode with Philip Olson, co-star of the PBS show Two Cents.

You may know Philip Olson (and his wife Julia Lorenz-Olson) for their quirky, fun web series Two Cents, a weekly personal finance show on PBS aimed at millennials and Gen Z. Philip and Julia also founded The Art of Finance, an Austin-based financial services firm that helps clients in the creative industry. Listen to how Philip and Julia manage their own money and home together.

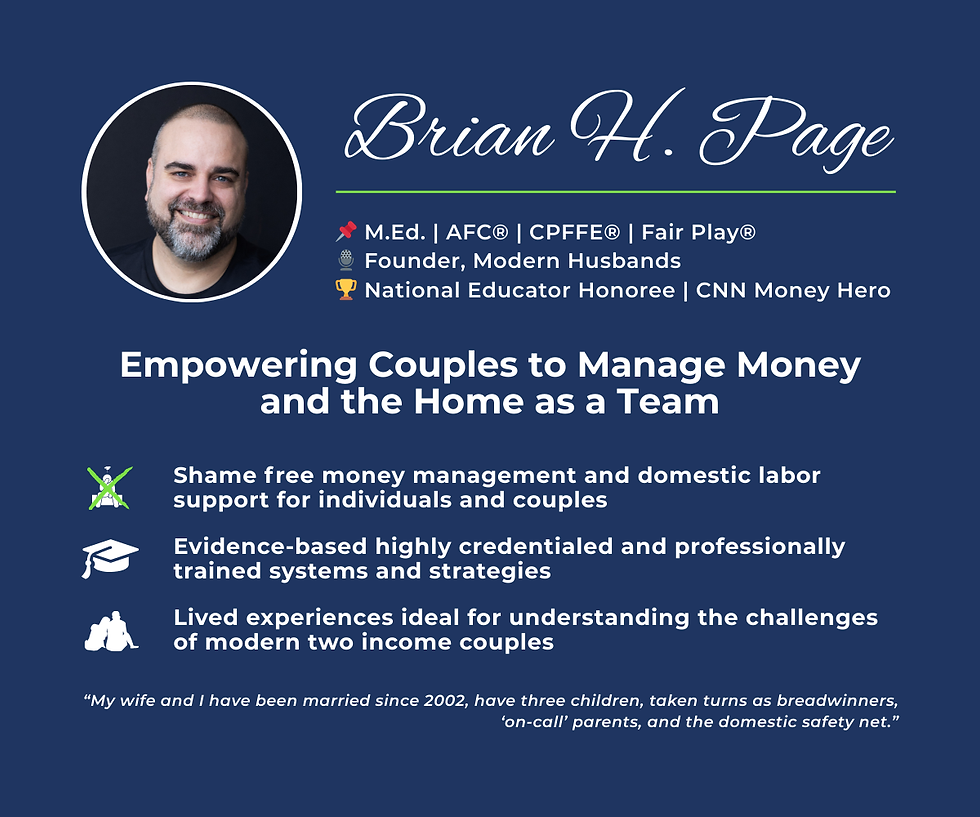

Professional Support

I support couples who want to better manage money or the home as a team in their relationship.

I'm an Accredited Financial Counselor® and Fair Play Facilitator®, empowering high-achieving couples with systems to manage money and the home as a team — drawn from decades of national leadership and lived experience.

Contact me to set up a free 15 minute exploratory call.

Follow Modern Husbands

Winning ideas from experts to manage money and the home as a team. 2023 Plutus Award Finalist: Best Couples or Family Content

🔔 Click here to listen and subscribe to the Modern Husbands Podcast on Apple.

🔔 Click here to listen and subscribe to the Modern Husbands Podcast on Spotify.

Winning ideas to manage money and the home as a team delivered to your inbox every two weeks. You'll even receive a few free gifts!

Citations

Archuleta, K. L., Britt, S. L., & Tonningsen, S. (2012). Financial disagreements and marital satisfaction: The role of financial knowledge and financial behaviors. Journal of Financial Therapy, 3(2), 1–18.

Dew, J. P., Britt, S. L., & Huston, S. J. (2012). Examining the relationship between financial issues and divorce. Family Relations, 61(4), 615–628.

Doherty, E. M., & Simmons, L. A. (2016). Couple money conflicts and marital satisfaction: A moderated mediation model. Journal of Family and Economic Issues, 37(1), 44–58.

Gorman, Elizabeth. (2000). Marriage and Money: The Effect of Marital Status on Attitudes Toward Pay and Finances. Work and Occupations - WORK OCCUPATION. 27. 64-88. 10.1177/0730888400027001004.

Kruger, M., Grable, J.E., Palmer, L. et al. Factors Associated with Couples Pooling their Finances. Contemp Fam Ther (2023). https://doi.org/10.1007/s10591-023-09666-9

Key Findings on Marriage and Cohabitation in the U.S. Marriage and Money: For Richer for Poorer: Money as a Topic of Marital Conflict in the Home, PEW Research

Papp, Lauren M et al. “For richer, for poorer: Money as a topic of marital conflict in the home” Family relations vol. 58,1 (2009): 91-103. doi:10.1111/j.1741-3729.2008.00537.x

Snyder, K. A., & Derry, R. (2016). Money matters: Couples' communication about finances and its effects on relationship satisfaction. Journal of Family and Economic Issues, 37(1), 44–58.

Xiao, J. J., Li, X., & Tang, C. (2011). Money, communication, and relationship satisfaction: The mediating and moderating roles of financial management behaviors. Journal of Family and Economic Issues, 32(4), 668–679.