The Cost of Raising Children and Other Personal and Family Expenses

- Brian Page

- Apr 26, 2023

- 10 min read

Updated: Jul 2, 2024

Updated post: 7/2/24 - Original post: 9/15/22

How to Budget When Your Spouse Won't: Part 8 of our 10 part budgeting series

Child Care and Child Support

How much do you believe it would cost on average to raise a child born in 2015, excluding saving for college?

$146,000

$185,000

$240,000

$310,000

My wife Hope and I were young when we had our first child. The first year he was born, Hope continued to work full time. I switched jobs, worked full time in the evenings to stay home with him during the day, and went to graduate school online late at night after work.

We eventually had more children, and the best financial move then was for me to work two full-time jobs while Hope stayed home with the kids.

In hindsight, this might have been a mistake. You can only work 80+ hour weeks before your mind and body begin to break down. Like many other women, Hope stayed home at the expense of her career. We were in survival mode and only considering the here and now.

The consequences for Hope, like many other women, are the compounding consequences of missed time on earnings and falling behind in investing for retirement and social security contributions. As a couple, this would need to be factored into your long-term financial plan.

According to the latest report from the USDA, the average cost of raising a child born in 2015 is just over $310,000. This does include saving for college or private school. What any of the graphics below fail to illustrate is the cost of time. Not the loss of time being a parent – those moments are priceless. Instead, the cost of time from the labor force, investment for retirement, doctor's appointments, and endless errands create stress.

Have kids on purpose and be prepared financially. The argument that you will never be prepared financially is nonsense and just an excuse to have kids before you're ready.

If you have kids, you’ll be able to complete our Budget Template for Couples using your current expenses. If you don’t have kids but want to know whether you can afford it, add $1,500 per child per month to the “other” budget category.

If you don’t make enough, anticipating additional income by working more or taking on a side hustle is a big mistake. That’s time you don’t have to give if you want to see your family.

Parenting is hard. It not only takes time to be a good parent, but it takes emotional energy. The more you work, the less emotional energy you have to be a great parent. To this day, I still can’t wrap my mind around the heroic grind of single and great parents.

Budgeting for future children is far more than a numbers game – it’s more important to forecast the time and energy you will have to be a great parent.

For dads out there, I am a big fan of Paul Sullivan and The Company of Dads. Paul also serves on our Voluntary Advisory Board. Paul is the Lead Dad for our three daughters and is creating a community for other Lead Dads like him and like me.

Personal and Family Expenses

The cost of children included in the report does include clothing, shoes, laundry, donations, and entertainment. However, it fails to dive into the details of how to budget for such items as a family.

Clothing and shoes

We need to be more materialistic. I was aghast when I heard this argument made in the documentary Minimalism: A Documentary About the Important Things by Dr. Juliet Schor, an economist and sociologist. She taught for 17 years at Harvard and is now at Boston College. And then she explained what she meant.

Being truly materialistic means that we genuinely value the few things we own, allowing us to live with less intentionally. This perspective speaks to me and minimizes the dangerous consumerism cycle perpetuated by societal norms.

Most clothing items and shoes have very little financial resale value, but it’s okay to purchase clothes and shoes just because you love them.

On the other hand, frugality can be taken to the extreme. My father, who is frankly my hero, is far from poor. He has done well financially. He is also the most frugal person I have ever met.

Take, for example, these pants. He purchased them when he cycled across the country 16 years ago at 60. The legs zip on and off, making it ideal for weather changes. Notice the color difference between the legs and the pants. He has no interest in purchasing new pants. He sees these as perfectly fine and wears them in public with pride. I love this about him.

Compulsive consumption is not the same thing as materialism. Compulsive consumption is when a person feels unable to control the desire to consume, often because they are trying to fill some emptiness or overcome anxiety. The more people value materialistic purchases, the more likely they will face depression, anxiety, and physical health problems. They even felt less satisfied with their lives.

Material purchases do make us happy. Initially, then the newness wears off. And it was the new and exciting feature of the iPhone, TV, or whatever you craved. Now you needed something else that was new because you've adapted to it.

You could argue that adaptation is an enemy of happiness. Other expenditures, such as experiential purchases, don't seem subject to adaptation.

Equally essential to point out that material purchase decisions are more likely to generate buyer's remorse. In contrast, regrets about experiential purchase choices are most commonly the regret of the missed opportunity, the option not to purchase the experience.

A material purchase you made last month might be on sale now, and maybe a different version was released that is far better. The nostalgia of newness may have worn off. In other words, there is less of a chance of buyer's remorse from experiences than from purchasing stuff.

There has to be a balance between ridiculous frugality, high-priced clothes and shoes, and preventing compulsive consumption. When managing money with a spouse not interested in setting or sticking to a budget, this can be particularly hard to define.

Two biases that lead to overspending

The Diderot Effect: An explanation from James Clear

"Diderot's scarlet robe was beautiful. So beautiful, in fact, that he immediately noticed how out of place it seemed when surrounded by the rest of his common possessions. In his words, there was "no more coordination, no more unity, no more beauty" between his robe and the rest of his items. The philosopher soon felt the urge to buy some new things to match the beauty of his robe.

He replaced his old rug with a new one from Damascus. He decorated his home with beautiful sculptures and a better kitchen table. He bought a new mirror to place above the mantle and his "straw chair was relegated to the antechamber by a leather chair."

These reactive purchases have become known as the Diderot Effect."

The Hedonic Treadmill

The hedonic treadmill is the process by which people generally return to their set point of happiness after either positive or negative events drive their happiness levels higher or lower than usual.

For example, you make a purchase and feel happy about your purchase, but you adapt to your new item and require more new things to reach an elevated level of happiness. Thus, the never-ending cycle of spending.

You want the feeling you had before when you purchased something new, so you decide to buy something else. This can lead to a never-ending cycle of spending.

When was the last time you invested a little bit of time to learn to save a lot of money with your partner? In our course designed to help couples learn how to save together, Money Marriage U Save, we review the Hedonic Treadmill in more detail.

Many people fall into the misconception that knowing about our biases makes us less susceptible to falling for them. The problem with believing that 'knowing is half the battle is incorrect, as studies in cognitive science have proven that simply knowing about our biases is not enough to change a behavior/habit. This is called the G.I. Joe Fallacy, and you will still fall subject to the natural tendency of believing that what you consciously know is the main thing that influences your behavior, but it's not.

The most effective strategy for you and your spouse to reduce thoughts of materialism is to change your environment.

Block or reduce ads in the settings of your online accounts or use ad blocker apps.

Choose experiences with friends and family to create joyful moments.

Foster intrinsic values such as building a life with the people you care about most, finding meaningful work, and participating in volunteer activities for the cause you care about.

Laundry

Budgeting for laundry begins with deciding whether to use a laundromat or purchase a washer and dryer.

I was impressed with what was written at Digest Your Finances, so rather than reinvesting the wheel, I’ll simply share his math. On average it will cost you around $2 per load of laundry at home and $5.25 at the laundromat. When you extrapolate this math, the break even point is 309 loads of laundry.

From Digest Your Finances:

The per load cost comparison does not include the cost of ironing. Of course, you could always purchase wrinkle release products.

Donations

According to research, people who spend money on others report more happiness. These benefits are most likely to emerge when giving satisfies one or more core human needs.

TED Talk How to Buy Happiness: Michael Norton

TED Talk Notes:

0:55 mark: How winning the lottery ruins people’s lives.

2:45 mark: An experiment on prosocial spending.

6:08 mark: How happy small and trivial giving choices make us.

6:27 mark: The global relationship between giving money to charity and happiness.

9:00 mark: How charity drives championship winning dodgeball teams.

What to give is generally broken into three categories: time, treasure, and talent. Deciding what to give depends on your goals and circumstances. Keep in mind that it’s not necessarily essential to give an abundance of something, but rather to give consistently.

Entertainment: Experiences>Possessions.

An abundance of research points to the fact that, on average, experiences make us happier when compared to possessions. Whether it is a concert, sporting event, or backpacking trip, what matters is living in the moment with people you like doing something you love.

Playing sports or watching your children play sports can bring joy when participating for the right reasons. I spent over a decade helping lead one of the most successful soccer organizations in the country. In my experience, when parents live through their kids, and players are being pushed too hard at too early of an age, they lose their love of the game. Making matters worse, relationships between parents and their children can become strained.

All three of our children have different interests, and we support whatever interests them. My middle child is a good enough soccer player to find suitable competition for him, and he needs to play for a high-level select team.

I love watching him play, and he loves the game. My wife and I were college athletes and did not need to live our athletic careers through our children, and I think this helps prevent any undue pressures and has created a special bond between my son and me.

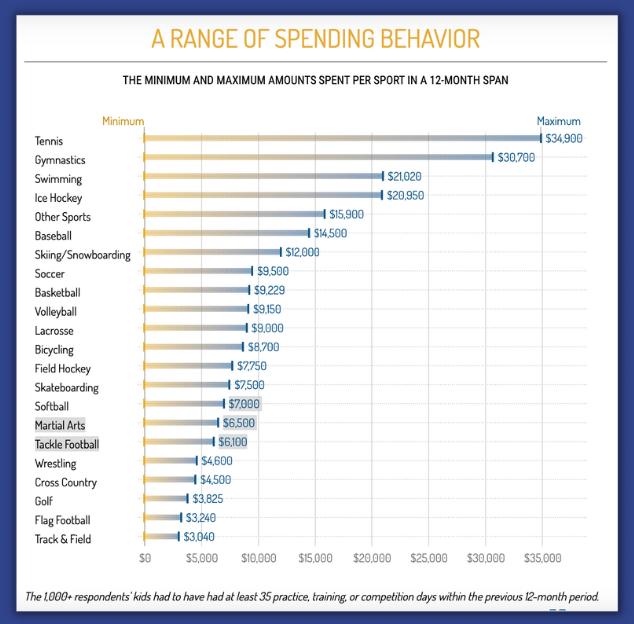

This is the role of select sports in the lives of us and our children. With this in mind, recognize that participating in select sports is expensive.

If your child is talented enough and loves the game enough to play select sports, you’ll want to find a way to provide that opportunity for them. However, be cautious about the age at which you share the cost of participation with your child. Balancing fostering an appreciation and respect for our sacrifices and a child’s potential feelings of shame or guilt is tough and can lead to financial enmeshment.

When you plan a budget with your spouse, you are not budgeting with Excel or other tools such as our Budget Template for Couples. You are using these tools. You are budgeting with someone you love and share your life with.

Our free Budget Template for Couples is designed specifically for couples. Each category includes linked graphic-centric short videos to help couples in the budgeting process, providing essential prompts to consider budgeting each categorically appropriately.

This 10-part series is dedicated to helping you work with a spouse to budget together and provide the information you need to make educated decisions with your dollars.

Learn More

Start, Strengthen, or Rebuild Marriages. For couples who want to manage money and the home as a team.

Winning ideas from experts to manage money and the home as a team. 2023 Plutus Award Finalist: Best Couples or Family Content

Winning ideas to manage money and the home as a team delivered to your inbox every two weeks. You'll even receive a few free gifts!

Citations

“Parents Projected to Spend $241,080 to Raise a Child Born in 2012, According to USDA Report.” Parents Projected to Spend $241,080 to Raise a Child Born in 2012, According to USDA Report, USDA, https://www.usda.gov/media/press-releases/2013/08/14/parents-projected-spend-241080-raise-child-born-2012-according-usda.

Long Work Hours, Part-Time Work, and Trends in the Gender Gap in Pay, the Motherhood Wage Penalty, and the Fatherhood Wage Premium

Kim A. Weeden, Youngjoo Cha, Mauricio Bucca

RSF: The Russell Sage Foundation Journal of the Social Sciences Aug 2016, 2 (4) 71-102; DOI: 10.7758/RSF.2016.2.4.03

Davis, Brent J, and Andrew Gellert. “Women Are Facing a Retirement Crisis - Tiaa Institute.” Trends in the Retirement Readiness Gender Gap among TIAA Participants, TIAA Institute, 22 June 2022, https://www.tiaainstitute.org/sites/default/files/presentations/2022-06/TIAA%20Institute-AARP_Women%20are%20facing%20a%20retirement%20crisis_WVOEE_Jenkins_July%202022.pdf.

Kassar, Tim. “What Psychology Says about Materialism and the Holidays.” American Psychological Association, American Psychological Association, 2014, https://www.apa.org/news/press/releases/2014/12/materialism-holidays#:~:text=We%20found%20that%20the%20more,felt%20satisfied%20with%20their%20lives.

Kristal, Ariella S., and Laurie R. Santos. G.I. Joe Phenomena: Understanding the Limits of Metacognitive Awareness ... Harvard Business School, https://www.hbs.edu/ris/Publication%20Files/21-084_436ebba8-c832-4922-bb6e-49d000a77df3.pdf.

Dunn, Elizabeth W., et al. “Prosocial Spending and Happiness: Using Money to Benefit Others Pays Off.” Current Directions in Psychological Science, vol. 23, no. 1, Feb. 2014, pp. 41–47, doi:10.1177/0963721413512503.

Kemnitz, R., Klontz, B. T., & Archuleta, K. L. (2015). Financial enmeshment: Untangling the web. Journal of Financial Therapy, 6(2), 32–48.

Lowery, G. (2010, March 31). Cornell Chronicle. Glee from Buying Objects Wanes, While Joy of Buying Experiences Keeps Growing. Retrieved February 17, 2022, from https://news.cornell.edu/stories/2010/03/study-shows-experiences-are-better-possessions.

Rosenzweig, Emily, and Thomas Gilovich. “Buyer's remorse or missed opportunity? Differential regrets for material and experiential purchases.” Journal of personality and social psychology vol. 102,2 (2012): 215-23. doi:10.1037/a0024999

Santos, Laurie. “The Science of Well-Being.” Coursera, Yale, https://www.coursera.org/learn/the-science-of-well-being.