THIS is the REAL REASON couples fight about money

- Brian Page

- Nov 16, 2023

- 5 min read

Updated: Feb 21, 2024

Money is the top cited reason for divorce and stress in a marriage. Scary stuff. So, what is the real reason couples fight about money? We'll get to that. But a few things first.

You can be wealthy and still fight about money. Many do. People of all income levels live beyond their means. Even some wealthy families. Wrap your mind around this:

According to the Report on the Economic Well-Being of U.S. Households in 2015 released by the Federal Reserve

Families whose household income exceeds $100,000, 1 in 10 spent more than they made that year.

That same year, the American Psychological Association’s annual Stress in America survey found that money is the top source of stress for American adults. 2015 was the seventh year in a row.

I chose 2015 as an example because we were not facing a recession, nor was the economy especially hot. 2015 was a routine year.

And I can assure you that for those who can afford it, making impulsive purchases on Amazon or driving a brand new luxury car will not make for a happier marriage if it leads to living beyond your means.

There are unlimited reasons couples could face the financial hardships that spark fights and frustrations, but you can't allow living a lifestyle beyond your means to be one of them.

This is unhealthy. Financially unhealthy. Financial stress causes suffering. It impacts marriages, jobs, and relationships with your children. Couples are fighting about money all across the country. Heck, you likely know friends or family members who do, but they probably don’t tell you. After all, it’s taboo to talk about money.

What couples should strive for, at a minimum, is financial health.

Think of it this way.

Being financially unhealthy is like being stuck in the hospital. You count on others to keep you going from one day to the next. You’re going to be stressed, and you’re going to be distracted. Everything else could be going well, but you can’t fully enjoy it. Sometimes, you end up in the hospital because of your choices. Sometimes, it was a choice someone close to you made. Other times, it is simply bad luck, but you must work through it all the same.

If you’re financially healthy, you have financial security and financial freedom of choice, now and in the future. The Consumer Financial Protection Bureau created criteria for financial well-being.

Financial Well-Being

The CFPB found that financial well-being includes the following elements:

Control over your finances

Having control over one’s finances in terms of being able to pay bills on time, not having unmanageable debt, and making ends meet.

The means to absorb a financial shock

Having a financial “cushion” against unexpected expenses and emergencies. Having savings, health insurance, and good credit.

Progress toward established financial goals

Goals such as paying off one’s student loans within a certain number of years or saving a particular amount towards one’s retirement.

The ability to make choices to enjoy your life

Choices such as taking a vacation, enjoying a meal out now and then, going back to school to pursue an advanced degree, or working less to spend more time with family.

You can assess your own financial wellbeing using their financial wellbeing interactive tool.

Financial health sits (or financial well-being) at the intersection of financial literacy, behavioral finance, and financial harmony.

Financial literacy is the ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing.

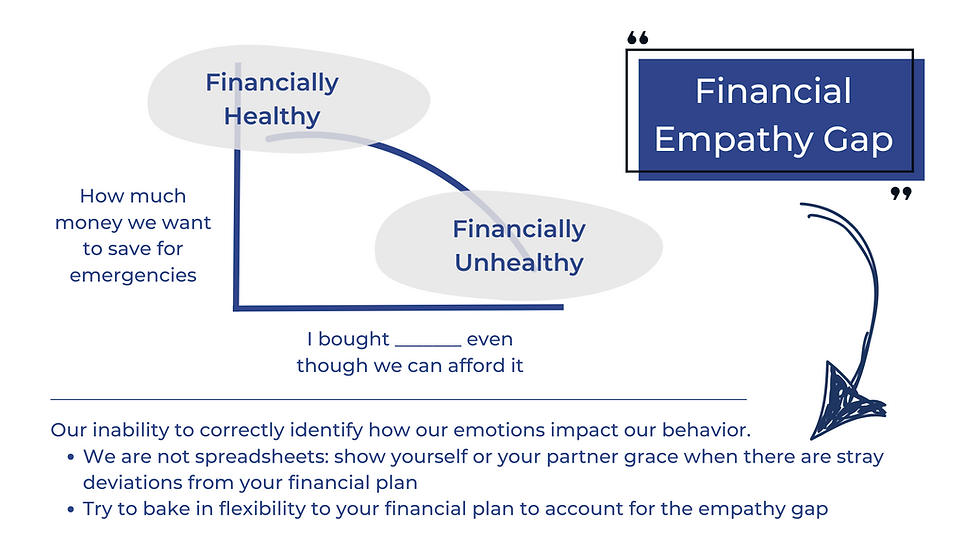

Behavioral finance asserts that rather than people being rational and calculating, we often make financial decisions based on emotions and cognitive biases.

Financial harmony is how well you and your partner can work together to manage money. It requires building a strong foundation of trust and shared financial goals.

Financial health is not achieved by compartmentalizing these concepts. They are interwoven in the collective choices made by spouses. Sometimes referred to as financial well-being, it is often at the core of financial stress and strain couples face.

The REAL REASON couples fight about money: Something is missing

You are arguing about money with your spouse because you are not financially healthy.

You are not financially healthy because between the two of you, something is missing: financial literacy, behavioral finance, or financial harmony.

Perhaps you or your spouse experienced financial trauma significant enough that rational financial decisions are nearly impossible to make. Yet, behavioral finance experts have developed apps at our fingertips that use science against our best interest.

You may have been denied your right to a high-quality financial education in school. You graduated into the school of hard knocks, and our schools failing to foster financial literacy as a part of who you are has left you feeling beat up, at no fault of your own.

Your parents may not have talked about money with you, modeled how to talk about money with one another, or worse, they could have set a bad example, making financial harmony impossible without help.

Managing money in a marriage, particularly when you’re barely making ends meet, is tough as it is. We all need all the help we can get, because it will lead to a happier marriage.

Fact:

Married couples are more likely to be happy when they both participate in sound financial management practices such as budgeting, saving, maintaining low debt, and living within (or below) their means.

The Solution

The solution: Make a commitment with one another to be financially healthy.

Use behavioral finance strategies to make saving easier and spending harder.

Dedicate yourselves to learning more about personal finance.

Commit to each other to be financially harmonious by meeting regularly and work together to manage money as a team

Growing through the journey together starts with having no shame with the decisions you have made in the past and not blaming your spouse for past decisions. Get right with each other, and then the learning can begin.

There are three ways you can follow Modern Husbands and learn from national finance experts in marriage and money to make your marriage stronger by together achieving financial health.

Subscribe to our YouTube channel. We will share long-form videos such as this one weekly, podcast episodes, and shorts for fast tips.

Subscribe to our newsletter. Every two weeks, we send out our latest articles, podcast releases, and free resources.

Subscribe to our podcast, the 2023 Plutus Award Finalist for Best Personal Finance Content for Couples and Families.

🔔 Click here to listen and subscribe to the Modern Husbands Podcast on Apple.

🔔 Click here to listen and subscribe to the Modern Husbands Podcast on Spotify.

And if you already follow us, will you help spread the word to help your family and friends?

We welcome ALL to the Modern Husbands community.